EV Owners Switching Back to Gas Vehicles

A recent analysis paints a picture. Almost half of households owning non-Tesla electric vehicles (EVs) opted for a gasoline-powered (ICE) vehicle for their next car purchase. This trend suggests challenges for automakers in keeping EV owners committed to electric models.

S&P Global Mobility found that only 52.1% of mainstream EV households remained loyal to EVs after their initial purchase, as of July this year. This is a worrying sign for the industry.

One reason behind this is the appeal of ICE vehicles’ strengths, such as towing capacity and payload. To keep customers loyal, automakers may need to boost their EV offerings.

Tom Libby of S&P Global Mobility indicated disappointment for car manufacturers embracing the EV market. “The OEMs are spending huge amounts of money to develop EVs,” Libby said. “The last thing they want is for an EV owner to go back to ICE.”

The report attributes part of the “loyalty struggle” to a dip in consumer interest in EVs. Consumer consideration is down to 52% from a 2021 high of 81%.

Several factors influence consumer choices.

- Pricing

- Limited infrastructure

- Restricted range

Some consumers opt for ICE or hybrid vehicles, seeking a workaround for these pain points.

Among non-luxury brands, Nissan has the highest EV loyalty. 63.2% of owners stuck with EVs, followed by Chevrolet at 60.6%. However, this doesn’t suggest that buyers remain with the same brand.

Analyzing individual models reveals more.

- 37.3% of Ford Mustang Mach-E owners purchased another EV, versus 45.8% switching to an ICE vehicle.

- Many buyers have moved to Ford trucks and SUVs, emphasizing the significance of vehicle type and capability.

- Tesla Model Y emerged as the most common choice for Nissan Leaf owners who bought another EV, followed by another Leaf.

- Leaf owners choosing non-EVs favored Nissan models like the Rogue, Pathfinder, Altima, and Sentra.

- 60.7% of Chevrolet Bolt owners stuck with EVs, with 25% buying another Bolt.

The story in the luxury EV sector is different. It has shown at least 70% customer loyalty for the past three quarters, and over 60% for the last year and a half.

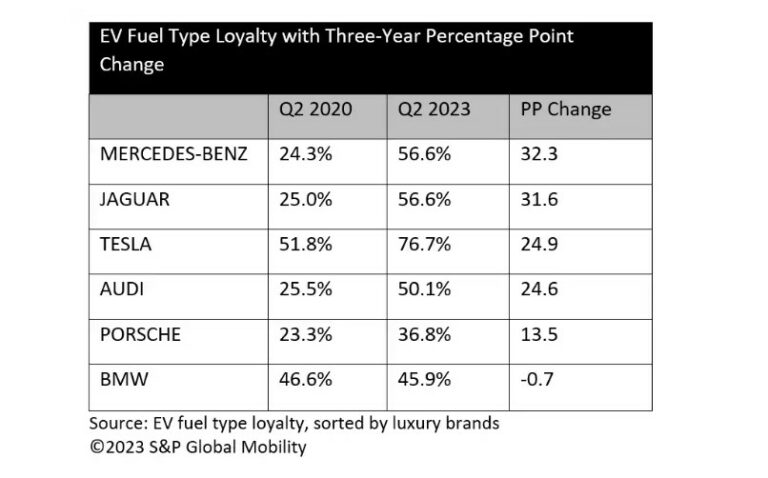

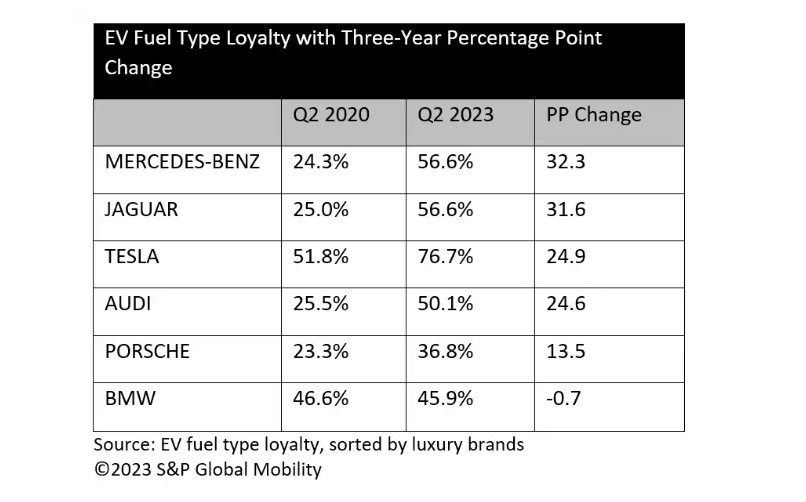

However, customer loyalty can differ across brands. If Tesla’s influence is removed, the analysis shows that some luxury brands struggle to retain customers interested in EVs.

Positive news is that many non-Tesla luxury brands have improved their EV loyalty rates, including Jaguar, Mercedes-Benz, and Audi. Interestingly, BMW had the highest EV loyalty rate three years ago, but this percentage has remained consistent.

The future is uncertain. Will the loyalty rates remain high as product lines age and competition increases? Will buyers of Mercedes-Benz EQS or Porsche Taycan models stick with EVs, buy from their legacy luxury brands, or opt for one of the 200+ EVs predicted to be available in 2026?