Luxury Car Market: An Overview of Size, Trends, and Future Growth

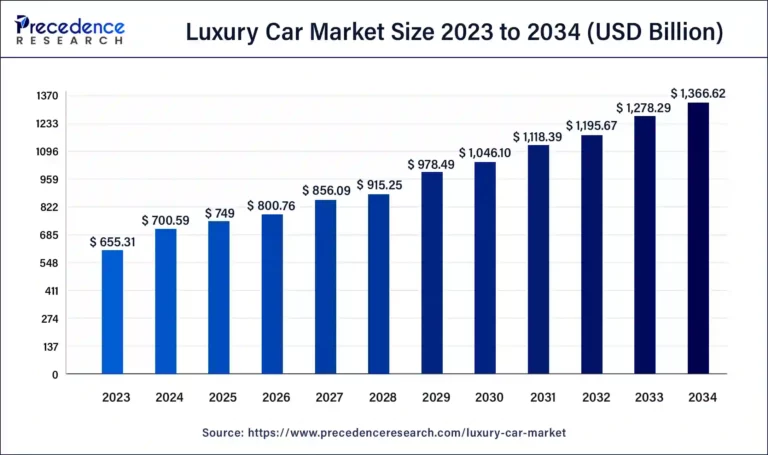

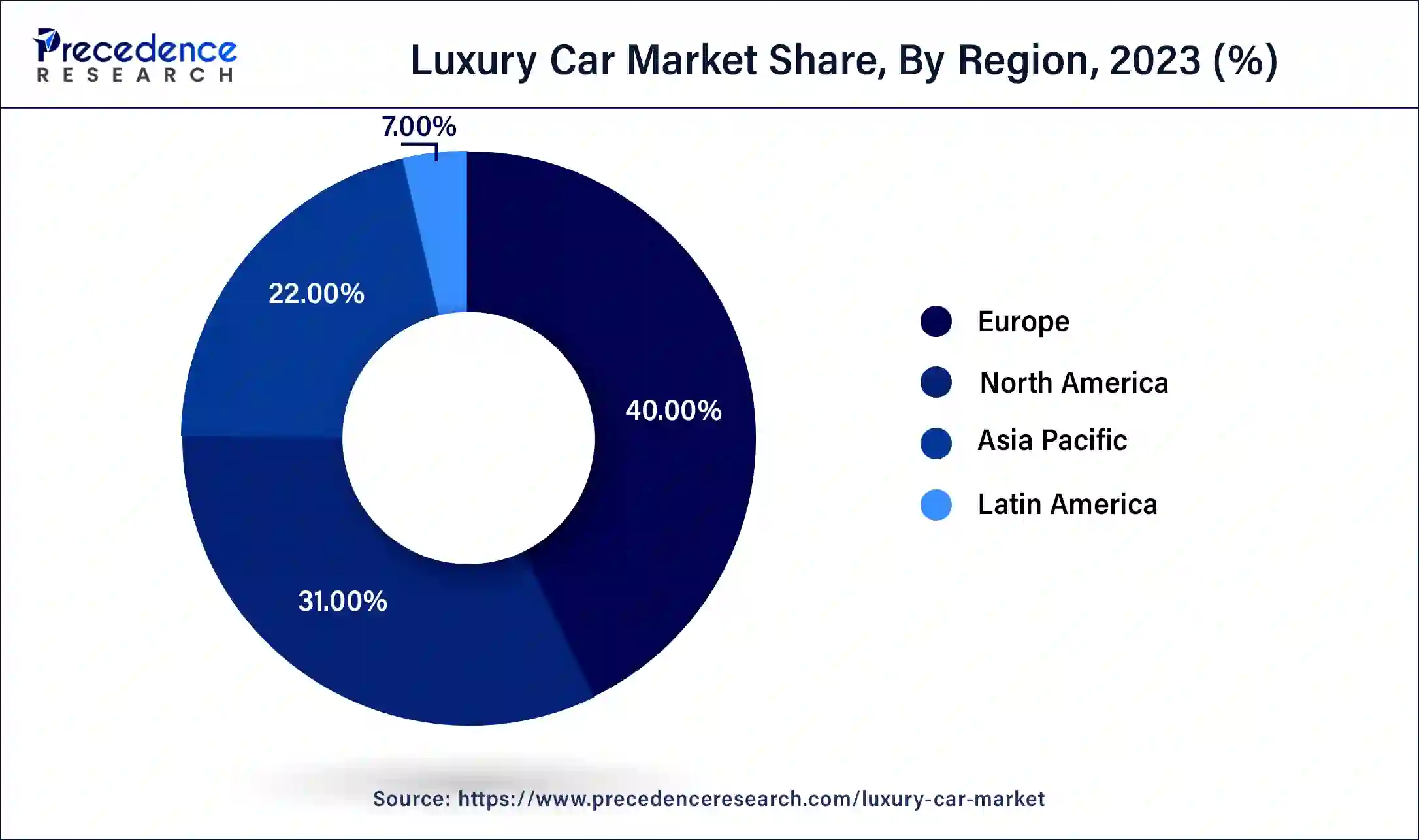

The global luxury car market continues to demonstrate robust growth, driven by evolving consumer preferences, technological advancements, and rising disposable incomes. The market, valued at approximately USD 700.59 billion in 2024, is projected to reach a substantial USD 1,366.62 billion by 2034, reflecting a compound annual growth rate (CAGR) of 6.91% between 2024 and 2034. This expansion underlines the increasing demand for high-end vehicles across various regions.

Key Market Highlights

- Market Size: USD 700.59 billion in 2024, expected to reach USD 1,366.62 billion by 2034.

- Growth Rate: CAGR of 6.91% between 2024 and 2034.

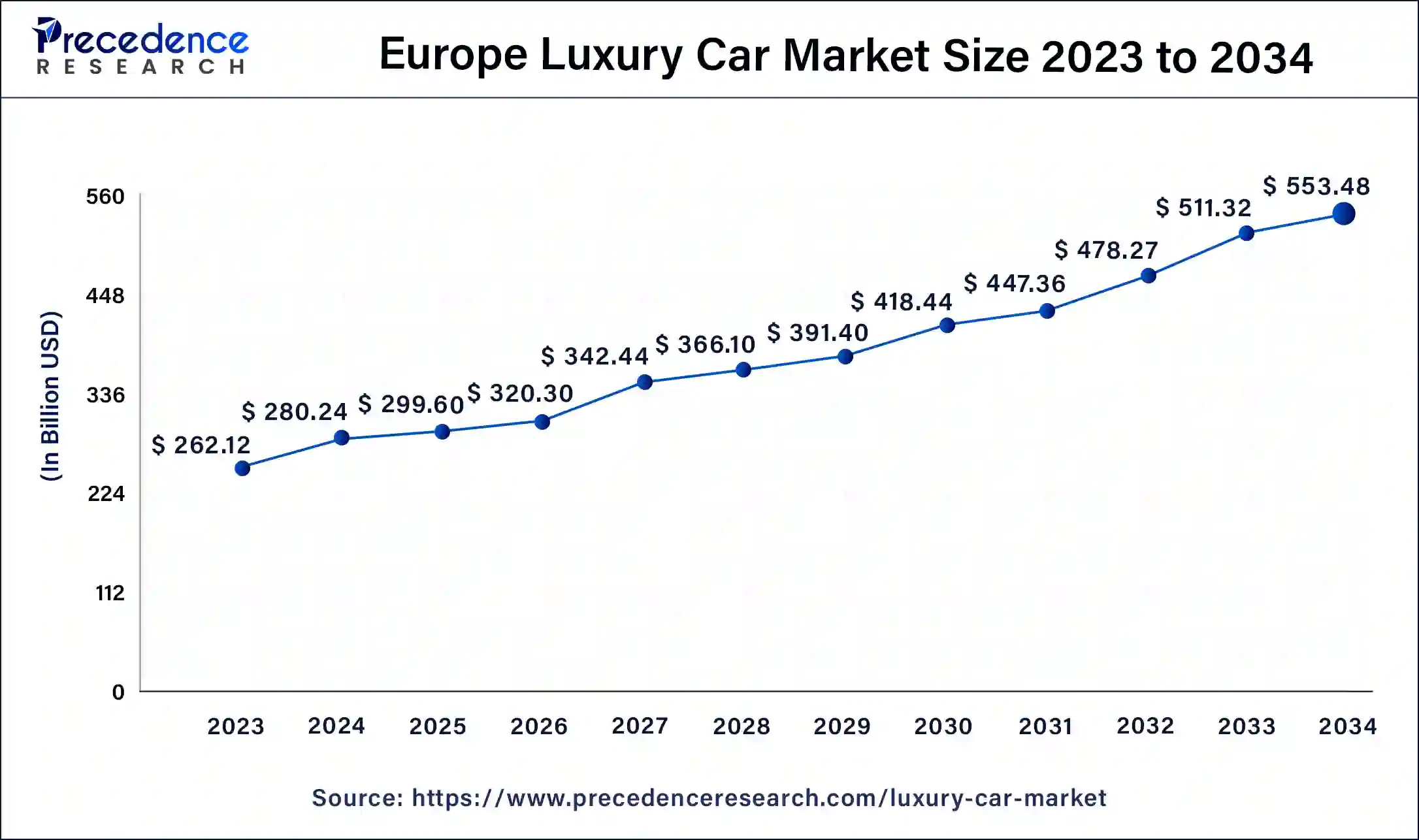

- Regional Dominance: Europe held the largest market share in 2023.

- Fastest Growing Region: Asia Pacific is anticipated to experience the most rapid growth in the forecast period.

- Vehicle Type: The sport utility segment led the market with a 59% share in 2023.

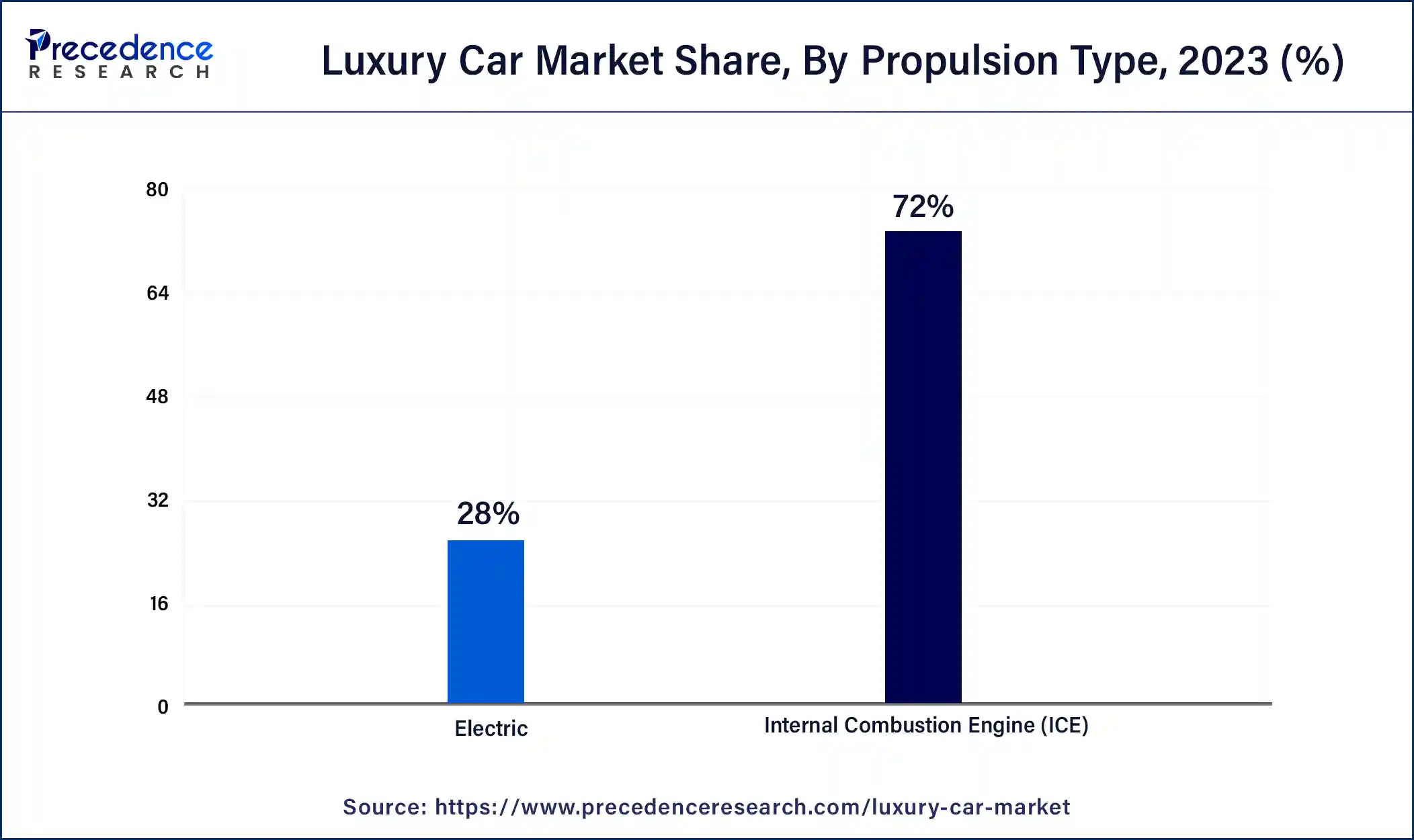

- Propulsion Type: Internal combustion engines (ICE) dominated with a 72% market share in 2023; however, the electric segment is growing rapidly.

Regional Market Analysis

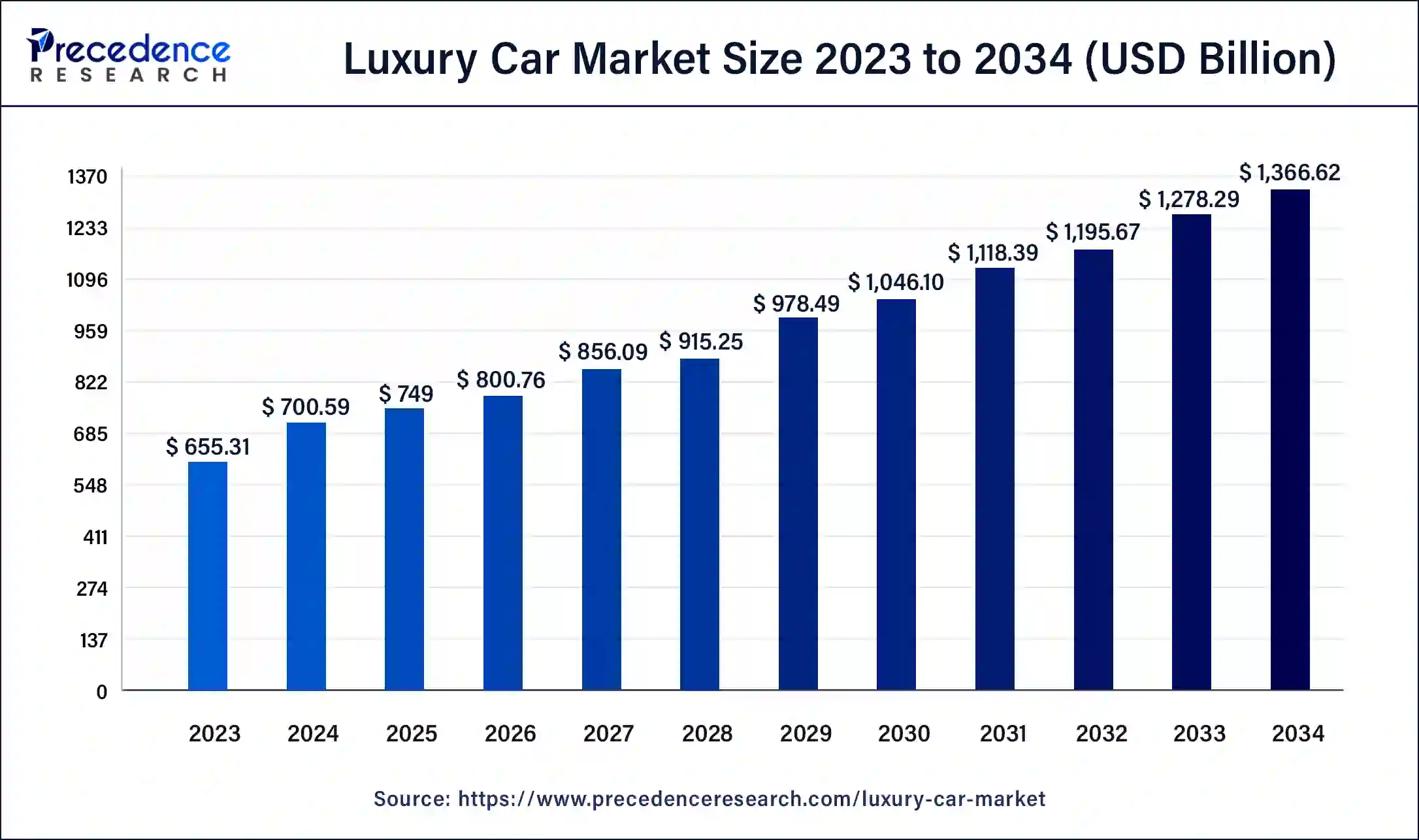

Europe

The European luxury car market, valued at USD 280.24 billion in 2024, is poised for significant growth, with a projected CAGR of 7.03% during the forecast period. The region’s well-established automotive market, along with the presence of leading automobile manufacturers, contributes to its expansion. Furthermore, government support and advanced industries for automotive manufacturing are driving factors.

North America

North America has also witnessed notable growth, led by the United States and Canada. Increasing adoption of luxury cars and a strong economy supported by a high proportion of affluent consumers are key drivers. The United States, in particular, stands out as a top consumer market.

Asia Pacific

The Asia Pacific region is predicted to be the fastest-growing market, fueled by rising disposable incomes, economic growth in countries like India, Japan, Korea, and China, and an increasing demand for high-tech vehicles. Government initiatives supporting electric vehicles and the launch of innovative luxury models by major players are also driving this expansion.

Market Overview and Growth Drivers

The luxury car market is expanding due to:

- Increasing Affluence: Growing number of affluent individuals and groups in emerging countries.

- Technological advancements: Including hybrid electric vehicles and electric vehicles.

- Changing Consumer Preferences: A shift towards SUVs and a preference for luxurious lifestyles.

Key players are heavily investing in multimedia and technological advancements to cater to the rising demand. Regionally, Europe and North America are prime areas for investment.

Recent notable developments include the introduction of the Mercedes-Benz EQS, India’s first locally-produced luxury electric car, and the introduction of a new production line by Toyota Motor Corporation for the Lexus LBX compact SUV.

Impact of Artificial Intelligence (AI)

AI is significantly influencing the luxury car market with innovations such as self-driving capabilities, and enhanced safety features through machine learning algorithms. Autonomous driving, as exemplified by Tesla’s Autopilot, is becoming increasingly integrated into luxury vehicles, which is set to transform the automotive industry and provide a competitive edge to those who implement the technology.

Market Growth Factors

The market’s growth is propelled by several key factors:

- Increasing production of luxury cars.

- Rising disposable incomes.

- Prestige associated with owning luxury vehicles.

- High safety features.

- Investments in newer technologies.

- Increasing popularity of SUVs.

- Growing affluent population.

Market Dynamics

Drivers

Key drivers of the luxury car market include superior performance, advanced safety features such as airbags and traction control, and integrated multimedia systems. These factors significantly influence the preferences of high-net-worth individuals.

Restraints

A major restraint to market growth includes the high costs associated with repairing luxury vehicles. The specialized nature of the required maintenance and the depreciation of these cars also pose challenges.

Opportunities

The rising demand for SUVs presents a major opportunity. Features like spaciousness, enhanced driving capabilities, and stylish appearances make SUVs highly attractive to families and young professionals, particularly in regions like China and North America.

Vehicle Type and Propulsion Type Insights

- Vehicle Type: The sport utility segment held the largest market share in 2023, driven by increasing aesthetic appeal and high-tech features. The hatchback segment is expected to grow rapidly due to rising disposable income and innovative models.

- Propulsion Type: The internal combustion engine (ICE) segment dominated in 2023 due to its established presence, accessibility, and performance. The electric vehicle (EV) segment is experiencing rapid expansion, especially in Asia Pacific, supported by government incentives and initiatives to reduce carbon emissions. Amazon, Zomato, and Uber in India are adding significant numbers of EVs to their fleets.

Key Players in the Luxury Car Market

Major companies operating in the luxury car market include:

- Mercedes-Benz Group AG

- BMW Group

- Volkswagen

- Tesla

- TOYOTA MOTOR CORPORATION (Lexus)

- Volvo Car Corporation

- Aston Martin

Recent Developments

Recent developments in the luxury car market include:

- April 2024: Li Auto Inc. introduced the Li L6 SUV.

- April 2023: Jaguar Land Rover announced plans to transition its Halewood plant to all-electric production.

- January 2023: BMW AG launched the i7 sedan in India.