Tokenization Transforms Luxury Goods Market

The tokenization of real-world assets (RWA) is reshaping investment landscapes, and a new wave of opportunities is emerging beyond traditional financial sectors. While the tokenization of real estate, precious metals, and fine art has gained traction, the tokenization of tangible luxury goods is becoming a significant trend. BeInCrypto spoke with Harley Foote, CEO and Co-founder of CryptoAutos, a leading project in the RWA luxury car market, to understand the rise of this phenomenon and its future prospects.

RWA Market Expansion and Potential

Real-world asset tokenization has emerged as a dominant theme in the cryptocurrency industry. Blockchain technology creates digital representations of traditional assets, enabling fractional ownership. This method democratizes access to expensive assets by dividing them into more manageable, divisible tokens.

Real estate, commodities, art, financial assets, and precious metals are among the most often tokenized RWAs. According to a report from the Tokenized Asset Coalition, the total market size of tokenized assets reached $186 billion in 2024 reflecting a 32% increase compared to the previous year.

“The RWA market has exploded in the last year due to a perfect storm of macroeconomic trends, technological breakthroughs, and changing investor sentiment. Institutional interest in blockchain-based assets, the growing adoption of ETFs, improved regulatory clarity in key jurisdictions, and the increasing need for liquidity in normally illiquid markets have all contributed to this acceleration,” Foote explained to BeInCrypto.

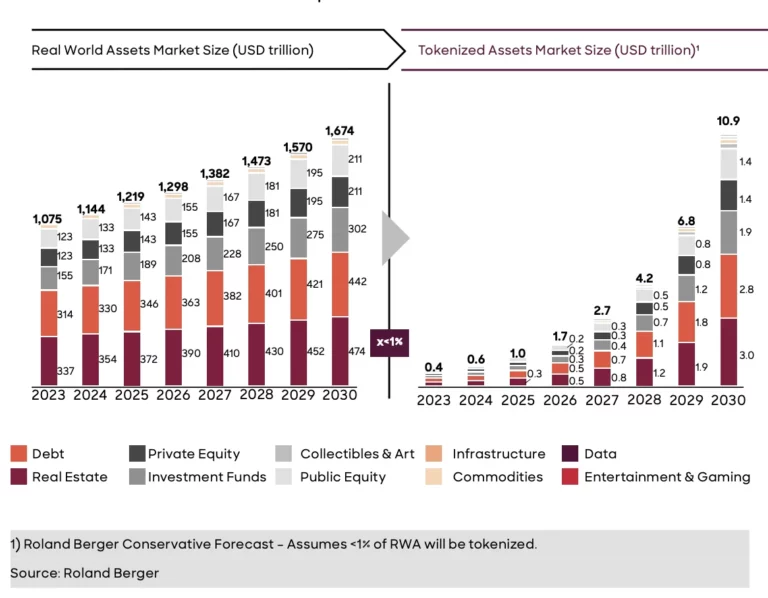

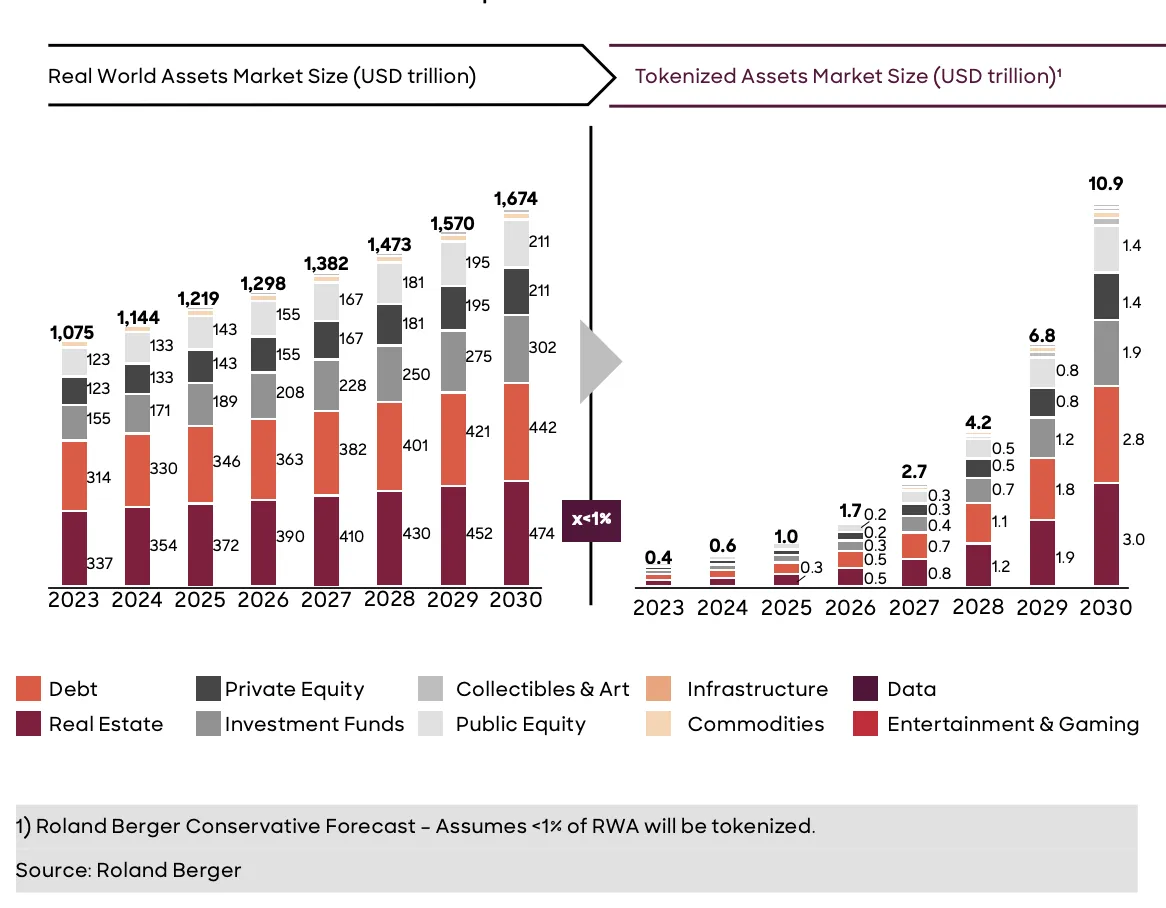

The industry’s future prospects remain promising. According to German consulting firm Roland Berger, the value of tokenized assets is expected to surpass $10.9 trillion by 2030. Real estate, debt, and investment funds are expected to be the top three tokenized asset categories.

The Rise of Tokenized High-End Goods

The tokenization of luxury goods, such as supercars, yachts, jets, and high-end watches, is quickly becoming a transformative trend. “At first, RWAs were centered on the tokenization of financial instruments such as bonds, real estate, and commodities, which made sense. However, as the technology has matured and investors have opened their eyes and had their interest piqued, we’re seeing a move into tangible assets with intrinsic scarcity and strong market demand, such as luxury automobiles, art, and collectibles. Supercars, for example, were initially reserved for ultra-high-net-worth people, but that is no longer the case because of tokenization,” Foote explained.

In 2020, the crypto startup CurioInvest announced the sale of tokens representing fractional ownership of a 2015 limited-edition Ferrari F12 TDF, offering these tokens priced at $1 each for a vehicle valued at over $1 million. The company also announced plans to tokenize 500 luxury automobiles, which they planned to store in a warehouse in Stuttgart.

In 2023, Cloud Yachts introduced a novel approach to the yachting industry by launching a tokenized experience related to superyachts. The NFT company tokenized a 94-foot Sunseeker super yacht, aiming to offer luxury yacht cruises to individuals for the cost of a night out in Miami. They sold each NFT for $500, granting purchasers one cruise around Miami on the Sunseeker 94 for a year.

Tokenized Luxury Vehicles

CryptoAutos recently acquired a $20 million luxury car rental fleet in Dubai, including limited-edition Lamborghini, Ferrari, Porsche, and Rolls Royce models. Customers will have an opportunity to earn USDT through the sale and rental of these vehicles.

According to Foote, luxury goods, particularly supercars, are well-suited for tokenization compared to other asset classes. “Unlike niche financial assets, luxury vehicles have universal appeal and recognition plus a liquid global market that attracts a wide variety of buyers. What sets supercars apart from other luxury assets, like fine art or jewellery, is their capacity to generate yield through rentals or shared ownership models, transforming what was traditionally a static asset into a dynamic revenue-generating investment. Additionally, supercars frequently function as a hedge against inflation. Supercars, like fine wine and vintage watches, have a tendency to outperform traditional investments during economic downturns,”

Democratizing Luxury Asset Ownership

Luxury vehicles are only within reach of individuals with disposable income in the millions. Tokenization alters the status quo.

“Conventional luxury car investments have been limited to elite collectors with sufficient capital to purchase and maintain rare vehicles. Previously, you had to pay for the whole car, but tokenization democratizes access. These new models can allow investors to own a share of high-value assets with minimal capital, trade their holdings in liquid markets rather than wait for an entire vehicle resale, and generate passive income from rental-based yields,” Foote told BeInCrypto.

Several supercars are limited editions, making them particularly well-suited for tokenization. “The wider car market is a depreciating asset. But supercars, limited-production hypercars, and classic models are particularly well-suited for tokenization because of their inherent scarcity, exclusivity, and strong global brand appeal. Limited production runs combined with collector demand naturally drives up value appreciation over time,” Foote said.

The growth of luxury goods in the RWA industry attracts attention from investors outside the crypto sector, potentially influencing RWA adoption in mainstream finance. “Luxury RWAs serve as a bridge between traditional investors and blockchain-based finance. We see the current progress towards tokenization of luxury assets, like supercars, yachts, and other items, only accelerating as mainstream adoption of RWAs takes hold,” Foote said.

The use of blockchain technology in these assets also inspires increased investor confidence when considering luxury goods as a means of portfolio diversification.

Blockchain’s Role in Curbing Risks

In high-value asset trading, blockchain technology improves transparency, liquidity, and security. According to Foote, blockchain inherently removes several inefficiencies and dangers associated with traditional asset ownership by providing transparent ownership at the source. “Each tokenized asset is recorded on-chain, ensuring a clear ownership history which helps prevent fraud. Investors can trade fractional shares of supercars, unlike conventional methods, eliminating the need for lengthy resale processes. Because of the speed of blockchain technology, you do not have to wait days for banks to clear your money; you can buy your car with a few clicks.”

Meanwhile, smart contracts further expedite the process and reduce risks. “Smart contracts enforce legal agreements, revenue-sharing models, and governance mechanisms, minimizing the need for intermediaries. Transactions are immutable and tamper-proof, increasing investor confidence,” Foote added.

Regulatory Frameworks for RWA Tokenization

Various jurisdictions globally have enacted regulations for this growing market, allowing investors access to tokenized RWAs. “Regulatory frameworks vary widely. Dubai, Switzerland, and Singapore have become favorable jurisdictions for asset tokenization, providing clear legal frameworks and investor protections. The United States and the European Union are still refining their RWA regulations, but we are seeing positive signs, particularly in the US under new leadership,” Foote said to BeInCrypto.

In November 2024, the Monetary Authority of Singapore (MAS) introduced new measures to facilitate the commercialization of tokenized assets. These actions included establishing commercial networks to increase liquidity in tokenized assets. The MAS also announced plans to develop a market infrastructure ecosystem and established industry frameworks for implementing and settling tokenized assets.

Switzerland remains a pioneer in the tokenization sector, backed by its comprehensive legal structure for digital assets. The country’s 2021 Swiss DLT Bill facilitated the secure and compliant tokenization of various asset types, drawing international participants to its market.

Dubai was the first jurisdiction to provide regulatory certainty for tokenized assets before Singapore and Switzerland. In 2020, it established the Virtual Assets Regulatory Authority (VARA), a regulatory body that overseas virtual assets. This authority focuses on regulating various virtual assets, including tokenized products, cryptocurrencies, and security tokens.

Establishing VARA provided regulatory clarity, creating a safe environment for businesses and investors to explore and invest in tokenized assets.

“Dubai is quickly becoming a global hub for tokenized luxury assets due to progressive regulations, strong investor demand, and a thriving crypto ecosystem. We’ve seen multiple projects like Mantra, Reelly, and of course, ourselves, make significant commitments to RWA operations in Dubai so far in 2025,” Foote stated.

Risks and Future Prospects

Although some countries have clear regulatory frameworks for virtual assets, most do not. The overall regulatory environment around tokenization is still evolving. Changes in potential regulation might have an impact on tokenized assets, necessitating that investors stay informed about the changing legal environment.

Meanwhile, tokenized assets, like other investments, are subject to market fluctuations. Even though tokenization can increase liquidity, it does not mitigate the volatility inherent in asset markets, particularly real estate and commodities.

“We would never shy away from the inherent risk of entering into a new market. Things like market volatility and general economic conditions can impact demand. So do the maintenance costs and potential regulatory uncertainty,” Foote noted.

Nevertheless, Foote is confident that demand for tokenized luxury goods is present and will remain. “Investors are increasingly seeking luxury assets which have strong utility coupled with appreciation potential. It’s a genuine new frontier that’s opening up right in front of us, and we are taking the opportunity with both hands on the steering wheel and turning the NOS up to the max,” he concluded.

While difficulties remain, the appeal of tokenized luxury products suggests that this is a developing market to watch.