Clean Freight Revolution: The Rise of Zero-Emission Vehicles

Let’s start with encouraging news: the move towards clean freight is gaining momentum. Over the past few years, the presence of zero-emission commercial trucks, delivery vans, and buses on our roads has steadily increased. This much-needed shift towards a cleaner, more equitable on-road freight system is accelerating, and not a moment too soon.

Medium- and heavy-duty vehicles (MHDVs), including the big rigs on our highways and the vans delivering packages, make up just over 10% of all vehicles on our roads. However, they are responsible for over half of the nitrogen oxide pollution that forms ozone, as well as a significant portion of fine particulate pollution harmful to the lungs. They also contribute disproportionately to climate-warming emissions, accounting for approximately 30% of greenhouse gas pollution from vehicles on our roads and highways. Zero-emission trucks and buses eliminate tailpipe emissions and substantially reduce pollution throughout their life cycle.

One clear indicator of this progress is the increasing rate of zero-emission truck and bus registrations. Tracking these registrations provides valuable insights into which fleets are adopting electric vehicles, the types of vehicles being deployed, and their geographical distribution. This information is crucial for understanding market development, but it’s equally important to examine the underlying factors driving this trend. This allows for a better understanding of what strategies are effective.

This shift within the nation’s $400 billion on-road freight industry requires both regulatory support and economic benefits to ensure lasting success. It’s not just about the technology; it’s about creating conditions where cleaner options make financial sense.

Smaller Vehicles and Large Fleets Lead the Charge

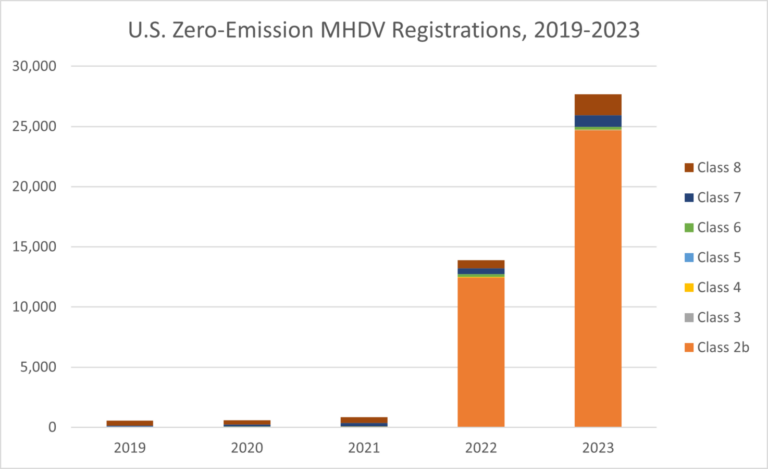

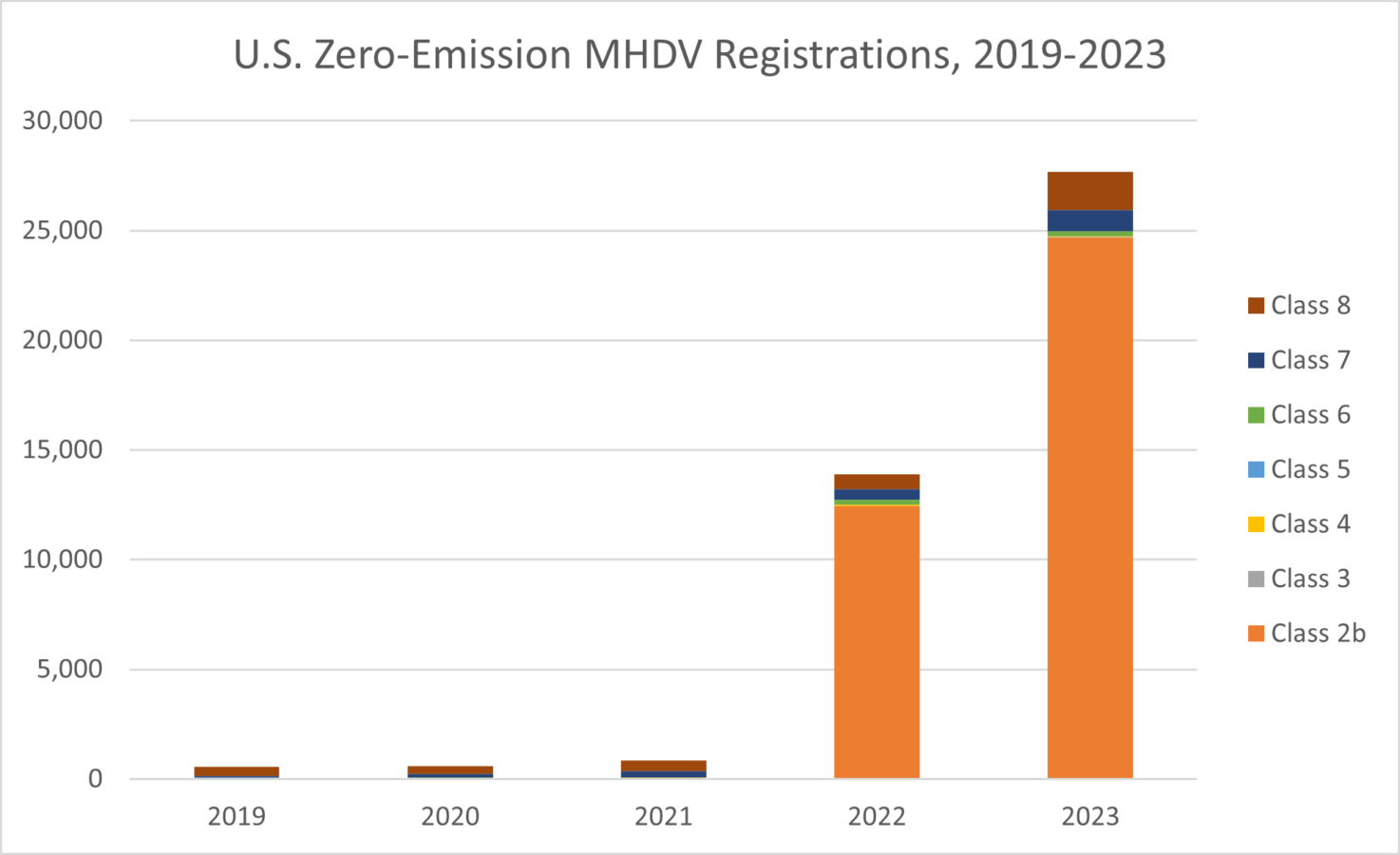

Just a few years ago, only a handful of zero-emission trucks and buses were deployed annually in the U.S. (around 600 in 2019). However, by 2023, over 27,500 zero-emission MHDVs were deployed. While this represents a small portion of the overall national MHDV sales (roughly 2.5% in 2023), the growth is impressive. Moreover, the adoption of zero-emission vehicles (ZEVs) among specific sectors of the MHDV fleet has shown remarkable growth in some states.

Cargo vans, which deliver packages and goods to our doorsteps, have experienced the most significant ZEV growth among all MHDV types. In 2021, only a limited number of zero-emission cargo vans were in operation nationally, but today, over 22,000 of these clean-operating vehicles are making deliveries across the country. In 2023, electric cargo vans accounted for over 7% of new registrations nationwide within this vehicle type.

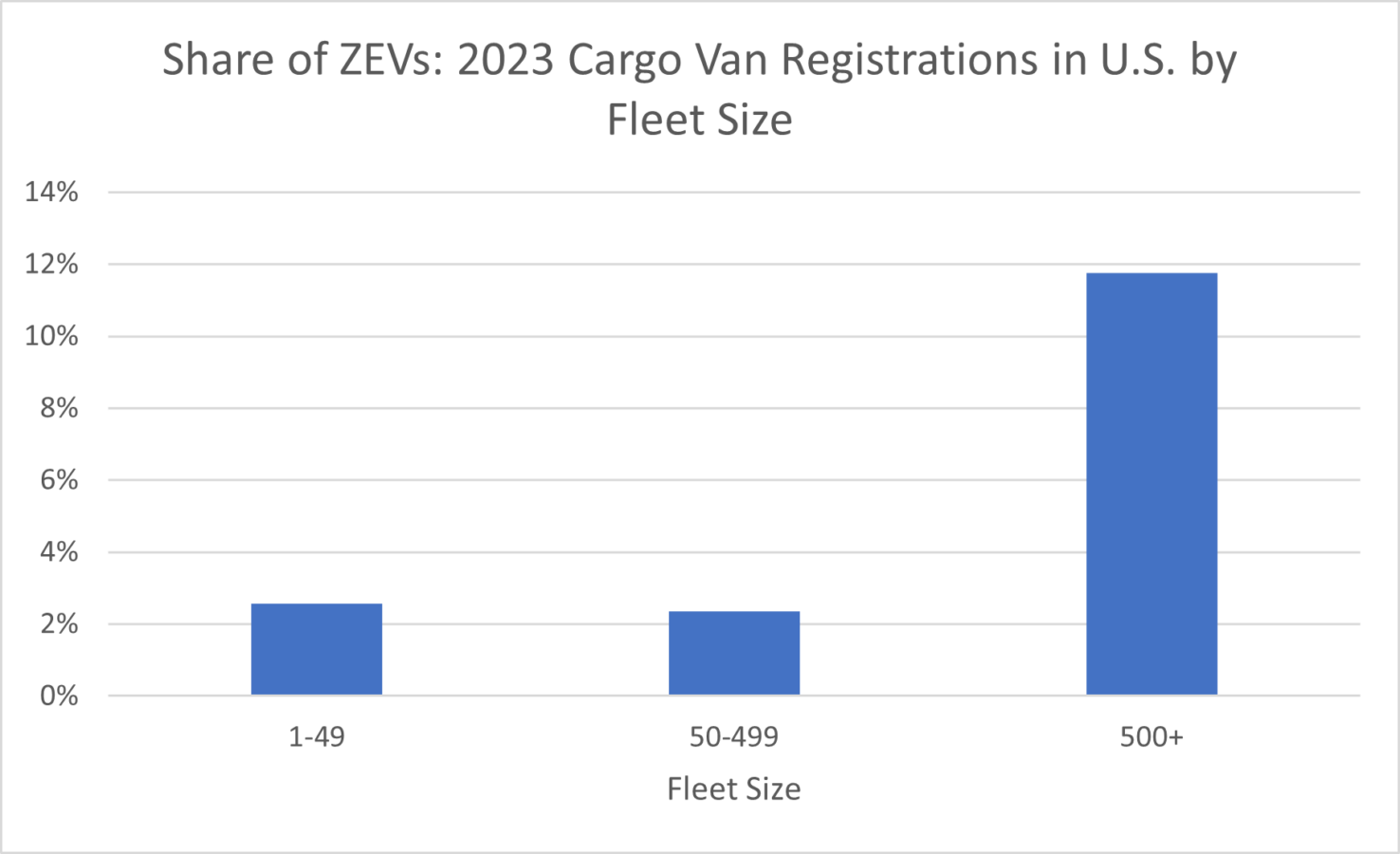

Larger companies are at the forefront of this early growth. Around 12% of cargo vans registered by businesses operating over 500 vehicles were electric in 2023, compared to 2.58% for fleets with fewer than 50 vehicles and 2.35% for those with between 50 and 499 vehicles. This difference can be attributed to larger companies having greater access to capital for investment, the potential for significant reductions in fuel costs, and greater flexibility stemming from a larger vehicle pool.

However, businesses of all sizes can benefit from the substantial fuel and maintenance savings offered by electric vehicles. Furthermore, increasing price parity between electric and combustion cargo and delivery vans makes these vehicles more attractive, especially for businesses working with less capital.

State-Level Adoption Rates

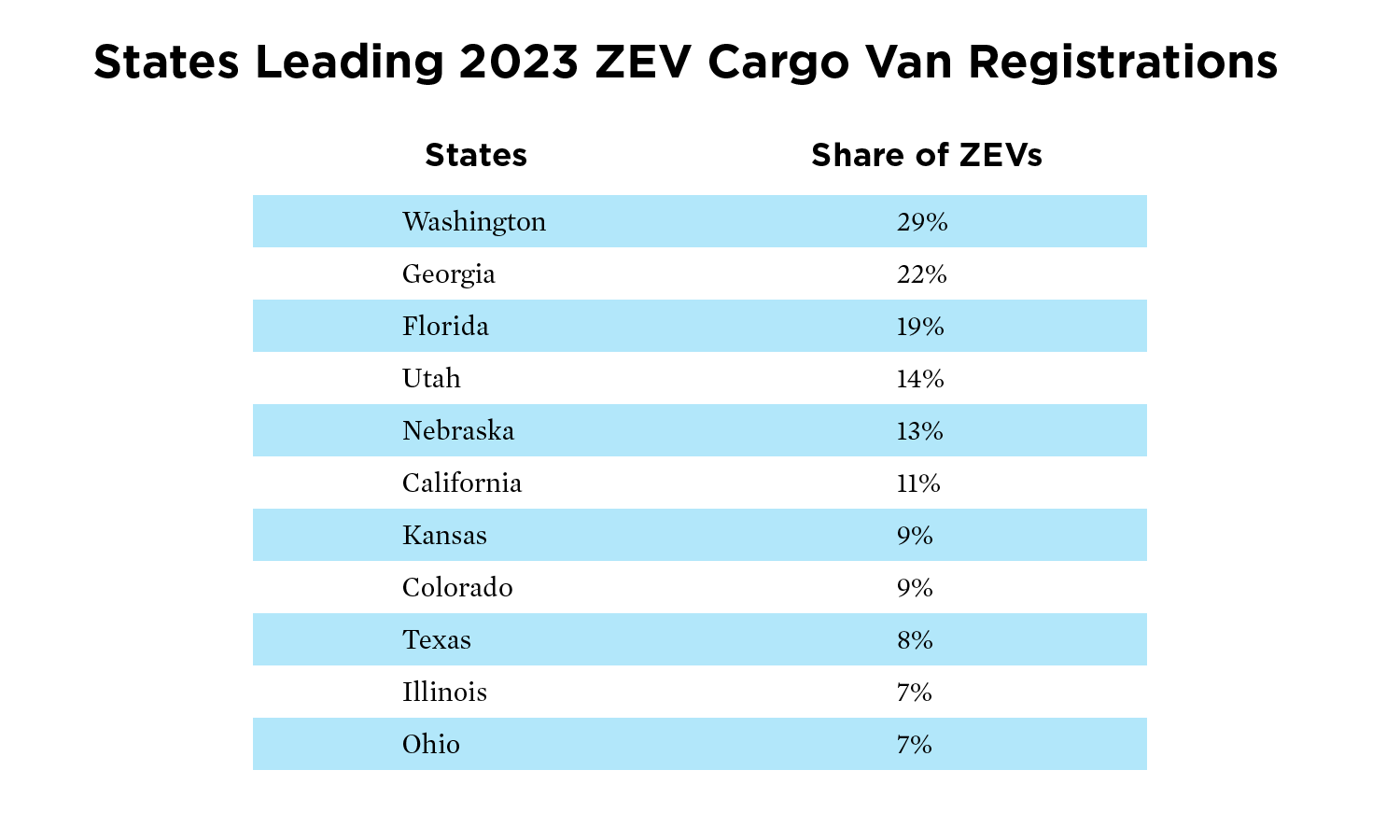

Some states are seeing more accelerated ZEV deployments than others. For example, in 2023, almost one in three cargo vans registered in Washington state were ZEVs. Georgia also showed impressive results, with over 22% ZEV registrations among cargo vans in 2023, representing a strong comeback for a state that once led in electric passenger vehicle adoption. Notably, Florida registered the most electric cargo vans last year, around 3,400, representing almost 20% of all registrations for that vehicle type. Several states stand out with an increased adoption of zero-emission cargo vans. This accelerated adoption is likely due to a combination of factors including electricity prices and increasingly strict regulations.

Key Factors Driving Adoption

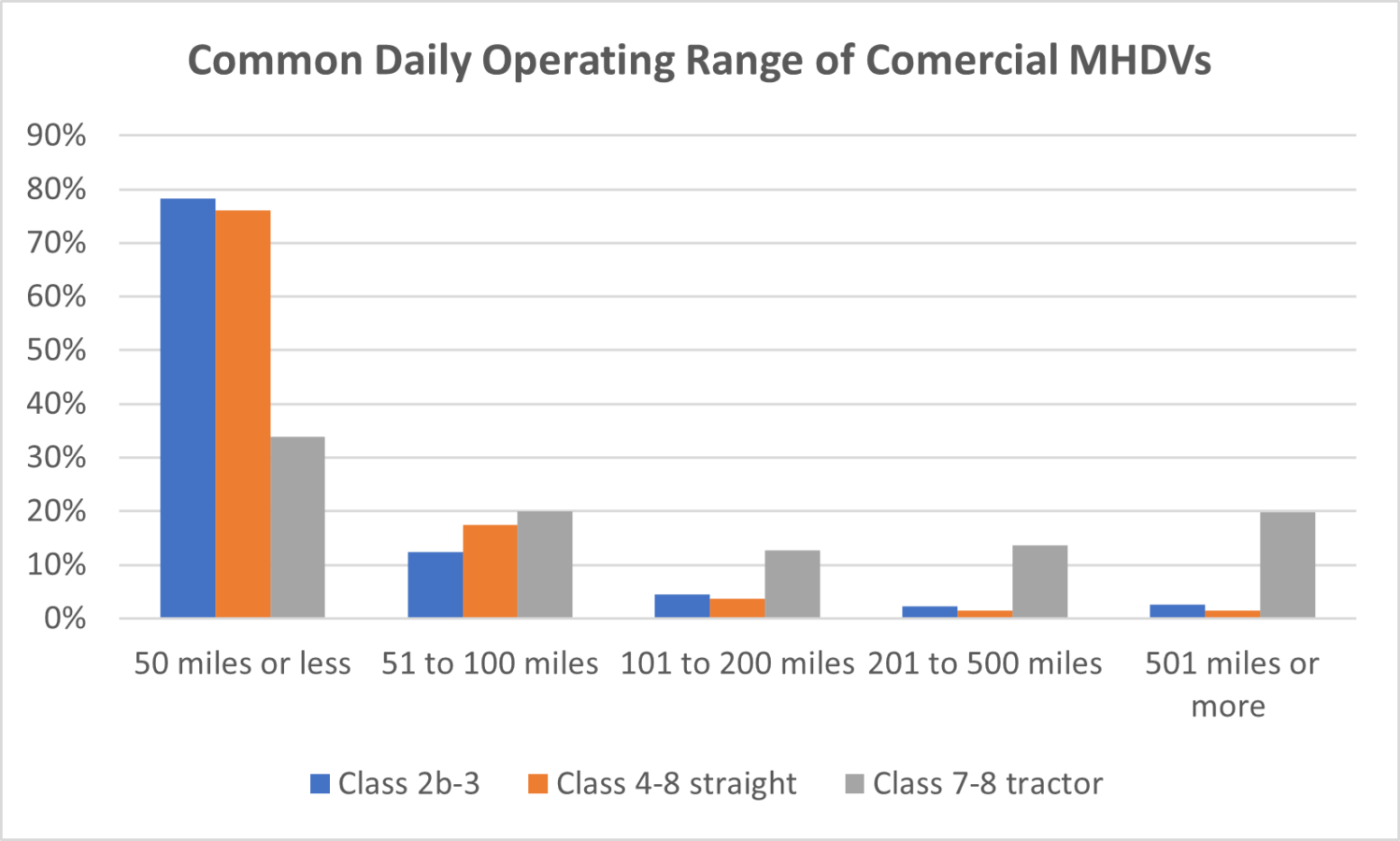

There are several key reasons behind this accelerated adoption of ZEVs. Electrification is particularly sensible for the last-mile delivery sector. Data from a recent Census Bureau survey of Class 2b and larger vehicles shows that over 90% of Class 2b and 3 trucks and vans travel less than 100 miles per day. Considering that the range of most common electric cargo vans on the market is around 150 miles, this makes electric vehicles a practical choice for many fleets. Furthermore:

- Delivery vehicles often operate on predictable or fixed routes.

- They return to a central depot after the workday.

- Electric vehicles can therefore easily charge overnight and be prepared for the next day’s work.

Another crucial factor is the lower operating costs associated with electric vehicles. Compared to combustion models, electric cargo vans often have significantly reduced operating costs. Using the current national average for electricity and gasoline prices, the fuel costs for the electric version of Ford’s Transit cargo van are approximately $0.10 per mile, while the gasoline-powered version costs about $0.19 per mile. In many cases, electric cargo vans have reached upfront cost parity with their combustion counterparts. For instance, the base price of Ford’s 2024 electric and combustion Transit cargo van models is virtually the same, at just over $50,000. This price parity is made possible in part by the $7,500 federal tax credit offered under the Inflation Reduction Act. Additionally, businesses may be eligible for further incentives, depending on their location. In California, for example, electric cargo vans qualify for an additional $7,500 incentive from the state.

Beyond incentives, the upfront prices of electric trucks and buses are expected to continue declining. A third reason for the rapid adoption of electric delivery vans relates to their charging infrastructure. While the costs of setting up charging infrastructure can be significant, last-mile delivery vehicles can readily charge overnight on Level-2 chargers. These are commonly found in homes and businesses, which considerably reduces charging hardware, construction, and permitting costs.

While the national public health, environmental, and climate impacts of delivery vans are smaller than those of larger, mostly diesel-powered trucks and buses, they are still significant. The Census Bureau reports that Class 2b and 3 vans in the U.S. travel over 33 billion miles annually. This is roughly equivalent to 20 round trips from Earth to Saturn. The climate impact of these vehicles is comparable to nearly 70 natural gas power plants operating for a year (26.02 million metric tons CO2e annually). Electric delivery and cargo vans also serve as an example of the potential for accelerated electrification within other sectors of our freight system.

Fleets operating larger vehicle types on similar routes have a path paved by electric cargo vans.

This growth is unequivocally impressive. Furthermore, given that delivery vehicles are almost everywhere in our communities across the country, their adoption could generate greater public interest in all-electric vehicles. In the coming months, UCS plans to follow up its 2019 report, Ready for Work, with additional research and analysis on early electric truck and bus adoption successes, future opportunities, and any remaining barriers to electrification—so, stay tuned!