UK LCV Market Sees Growth in 2024, but EV Adoption Lags

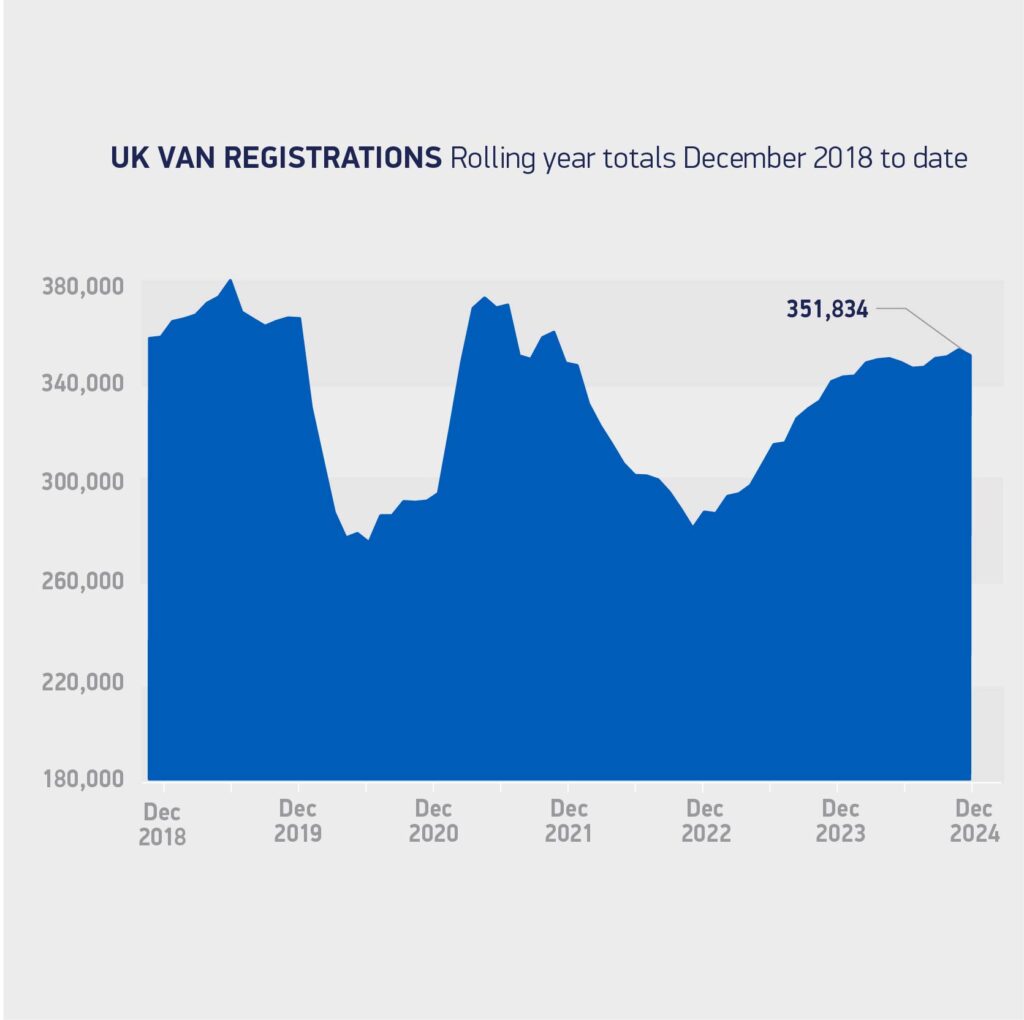

The UK light commercial vehicle (LCV) market experienced a positive year in 2024, with registrations surpassing 350,000 units. However, the growth in electric van uptake remained stagnant, raising concerns about the pace of decarbonization within the sector.

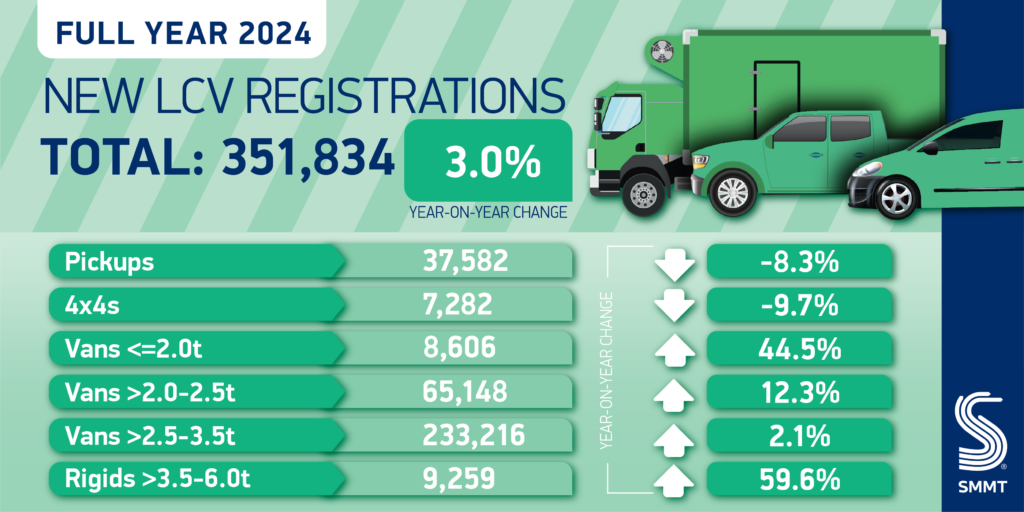

According to the latest figures released by the Society of Motor Manufacturers and Traders (SMMT), new LCV registrations increased by 3.0% in 2024, reaching a total of 351,834 units. This marks the best year for fleet renewal since 2021. A robust December, with 27,221 new LCVs registered, contributed to the overall positive trend.

Sector Breakdown

Demand grew across all van weight classes. The largest vans saw a 2.1% increase in uptake, representing 66.3% of the market. Medium-sized vans experienced a significant rise of 12.3%, and small vans saw an impressive 44.5% growth in registrations.

However, not all segments saw positive results. Registrations of new 4x4s declined by -9.7%, reflecting the fluctuations in smaller volume sectors. More concerning was the -8.3% drop in new pick-up registrations, totaling 37,582 units. This decline is expected to worsen in 2025 due to the government’s decision to tax double-cab pick-ups as cars, impacting businesses that rely on these vehicles, such as those in farming and construction.

Electric Van Performance

While the overall LCV market demonstrated growth, the battery electric van (BEV) sector presented a mixed picture. New BEV registrations rose by 3.3% to 22,155 units. The share of the overall market held steady at 6.3%, the same as in 2023. This incremental progress highlights the challenges ahead in accelerating the decarbonization of light commercial vehicles.

Despite a wider array of zero-emission van models available to UK operators—33 different models representing over half (52.4%) of all new LCV models available—the lack of dedicated public chargepoints hinders fleet confidence in the commercial viability of electric vans. This situation is even more problematic when considering that the 6.3% share is significantly short of the government’s 10% target for 2024 set by the Zero Emission Vehicle Mandate.

If demand rises by 85% in 2025, as the industry expects, the UK’s BEV share would still reach only 10.6%, falling short of the 16% required for this year.

Industry Concerns and Recommendations

With the current market demand for BEVs lagging behind expectations outlined in the mandate, the government is urged to expedite a review of the regulation. This review should consider market realities, address existing barriers, and provide the necessary support for growth. The industry emphasizes that ambitious regulations must be coupled with equally ambitious incentives and infrastructure investments to drive adoption successfully.

Mike Hawes, SMMT Chief Executive, commented on the findings:

Vans, 4x4s and pick-ups keep businesses everywhere on the move, making this sector a barometer of the UK economy. The best overall volume in three years, therefore, is good news with van makers striving to deliver abundant and competitive EV choice. Buyer confidence, however, will inevitably be undermined when charging infrastructure does not meet the needs of fleet operations. A review of EV regulation is crucial, therefore, to reflect current market realities and ensure ambitions are deliverable, without any negative and costly consequences.

Additional Notes

- In 2021, UK new LCV registrations totaled 355,380 units.

- SMMT and the National Farmers’ Union (NFU) jointly appealed to the Chancellor to uphold HMRC’s decision to uphold double-cab pick-ups’ status as commercial vehicles.

- SMMT’s BEV figures include vehicles from the Vehicle Emissions Trading Scheme.

- UK operators have a choice of 33 electric LCV models. There are a total of 63 LCV models available.