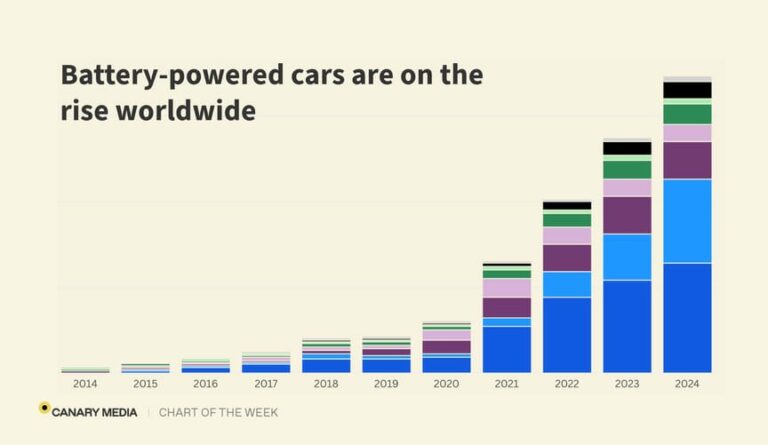

Global Electric Vehicle Adoption Continues to Accelerate

Despite challenges in key markets like the U.S., the global shift to battery-powered vehicles is moving forward. According to a new International Energy Agency (IEA) report, more than one in five new cars sold worldwide last year were either fully electric or plug-in hybrid vehicles (PHEVs). This year, the IEA forecasts that electric vehicles (EVs) and PHEVs will make up more than a quarter of new car sales globally.

China Leads the Way in EV Adoption

China, the world leader in EV and battery manufacturing, continues to drive the adoption of electric vehicles. Over 17 million fully electric and plug-in hybrid vehicles were sold worldwide last year, with more than 11 million of those being in China alone. The country saw a significant increase in PHEV sales, with nearly double the number hitting the road in 2024 compared to 2023. Almost half of all cars sold in China last year were EVs or PHEVs.

Europe’s EV Market Shows Mixed Results

Europe is the next-biggest region for electric vehicle adoption, although it experienced a slowdown last year. The number of EVs and PHEVs sold across the continent remained roughly the same as in 2023. This stagnation is largely attributed to the phase-out of EV subsidies in major European countries like France and Germany. However, sales grew in over half of the European Union’s 27 member states, with significant increases in the United Kingdom, the second-largest auto market in Europe.

U.S. Market Faces Uncertainty

The U.S. electric vehicle market saw modest growth in 2024, with about 10% more EVs and PHEVs sold compared to the previous year. This growth occurred despite Tesla, the dominant player in the U.S. EV landscape, recording a decline in sales. Emerging markets also contributed to the global growth, with over 60% more EVs and PHEVs sold in 2024 compared to 2023. India and Thailand were among the largest emerging markets, although countries like Brazil, Vietnam, and Indonesia saw rapid rises in EV sales.

Outlook for 2025

The outlook for this year remains solid, with the IEA expecting more than 20 million EVs and PHEVs to be sold worldwide. China’s continued expansion of its EV fleet is expected to drive global sales. While Europe’s sales might rebound slightly due to new policies incentivizing EVs, the biggest uncertainty lies in the U.S. market. Potential tariffs, policy rollbacks, and the likely repeal of the consumer EV tax credit could dampen the adoption of electrified models in the country.

Despite these challenges, the global shift towards electric vehicles is expected to continue, driven by growth in regions outside the U.S. As the world moves towards a more electrified transportation sector, countries that adapt quickly to these changes are likely to benefit from the transition.