California’s EV Market: Tesla’s Hold Weakens in 2024

California continues to lead the U.S. in electric vehicle (EV) adoption, boasting approximately five times more EVs on its roads than any other state. It also holds the top spot for EVs per capita. In 2024, California accounted for 31.1% of all EV sales in the U.S. – a figure that, if it were a country, would have made it the second-largest EV market globally, surpassing the UK and Germany.

Despite this significant presence, California’s EV market share saw only a modest increase in 2024, rising from 21.7% to 22%. A closer examination, however, reveals more complex dynamics. While overall auto sales dipped slightly (0.3%), EV sales experienced a 1.2% increase.

Tesla’s Market Share

Tesla remains the dominant EV brand in California, accounting for 52.5% of EV sales last year. However, this is a decrease from its 2023 share of 60.1%. Moreover, Tesla’s sales volume declined from 230,010 units in 2023 to 203,221 in 2024, even as the overall EV market expanded.

Other Brands Rise

Excluding Tesla, eight of the top ten EV sellers saw sales growth in 2024 compared to 2023. This growth from other brands, combined with the broader expansion of the EV market, offset Tesla’s sales decline. The key questions for the California EV market going forward are the extent to which these other brands will increase their EV presence and whether Tesla’s sales will rebound.

Though still the leading EV brand in California, Tesla’s position is softening. Toyota’s sales increased by 4.4% (or roughly 12,000 units), Honda’s sales grew by 11.5% (approximately 20,000 units), and Tesla’s sales decreased by roughly 11.6% (or around 27,000 units)

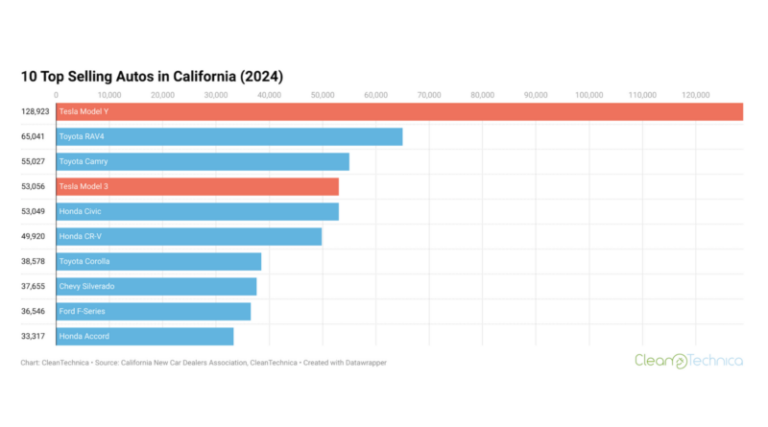

In 2023, the Tesla Model Y and Model 3 were the best-selling and second-best-selling vehicles, respectively. Although the Model Y kept its lead, the Model 3 fell to fourth place in 2024, despite a refresh. Model 3 sales dropped significantly, from about 83,000 in 2023 to around 53,000 in 2024.

In the SUV and truck segment, the Model Y continues to outperform the competition, with nearly double the sales of the second-place Toyota RAV4. In the ranking of top-selling cars (sedans), the Model 3 dropped to second place, narrowly being passed up by the Toyota Camry.

In its niche categories, the Model Y dominates the “luxury compact SUV” class, and the Model 3 leads the “near luxury cars” market ahead of the BMW i4.