Canada’s Electric Vehicle Availability Standard

Canada is accelerating its transition to electric vehicles (EVs) with a new Electric Vehicle Availability Standard. This standard, announced on December 20, 2023, aims to significantly reduce greenhouse gas emissions from the transportation sector, a key component of Canada’s 2030 Emissions Reduction Plan.

This plan targets a reduction of at least 40 percent in emissions below 2005 levels by 2030.

The regulations apply to light-duty vehicles, including passenger cars, SUVs, and light trucks, which account for about half of Canada’s transportation emissions and 25% of the country’s overall greenhouse gas emissions.

ZEV Sales Targets

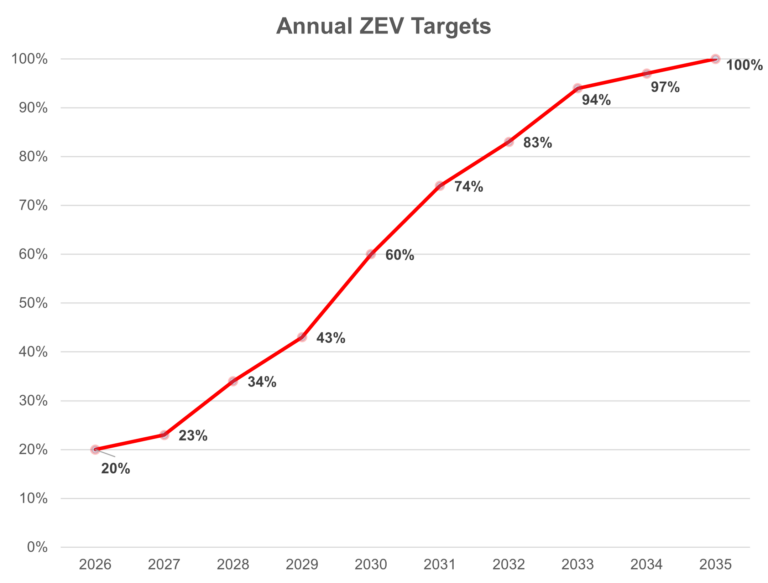

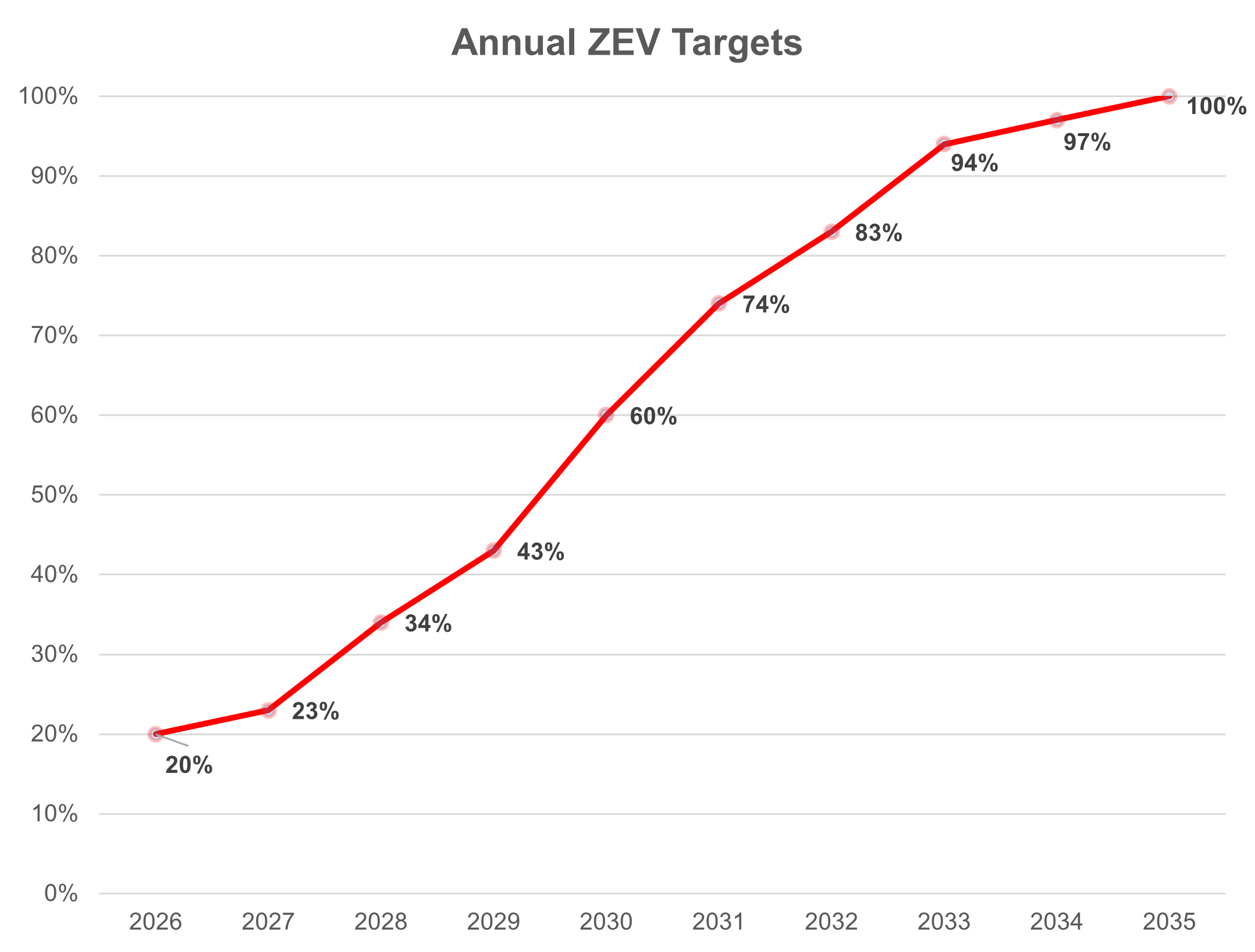

Under the new standard, auto manufacturers and importers must meet annual zero-emission vehicle (ZEV) sales targets. These begin in the 2026 model year, requiring at least 20 percent of new light-duty vehicles offered for sale to be ZEVs. The targets then increase annually.

The target is 60% by 2030 and 100% by 2035.

- 2026: 20%

- 2027: 23%

- 2028: 34%

- 2029: 43%

- 2030: 60%

- 2031: 74%

- 2032: 83%

- 2033: 94%

- 2034: 97%

- 2035 and beyond: 100%

With the average vehicle lifespan of 15 years, the 2035 target seeks to eliminate the use of polluting light-duty vehicles by 2050.

What are Zero Emission Vehicles (ZEVs)?

The regulations cover manufacturers and importers of new passenger cars, SUVs, and pickup trucks. However, they have the option to exclude emergency vehicles from these sales requirements.

ZEVs are defined as:

- Battery-electric vehicles (BEVs) powered solely by electricity.

- Fuel-cell vehicles (FCVs) using hydrogen.

- Plug-in hybrid electric vehicles (PHEVs) capable of running on electricity for a minimum distance before switching to a hybrid mode with liquid fuels and electricity.

Currently, ZEVs come in various forms, including pickup trucks, SUVs, sedans, and hatchbacks, available with two- and four-wheel drive options. In 2023, over 50 ZEV models were available in Canada, an 80 percent increase from 2019, and another 41 are expected in 2024.

North American Context

Canada’s regulations align with similar standards adopted by several US states. California mandates that 100% of new vehicles be ZEVs by 2035, and other states, including Colorado, Delaware, Maryland, and others, will implement similar standards starting in 2026 or 2027. By 2027, over 40 percent of the North American vehicle market could have comparable ZEV requirements.

These Canadian regulations echo ZEV definitions and credit systems similar to those in California and participating US states, especially regarding PHEVs.

Benefits of the Regulations

The regulations aim to increase the supply of ZEVs, meet consumer demand, and enhance consumer choice. This approach offers a gradual transition, and most industry forecasts predict that the price of gas-powered versus electric cars will be comparable by the end of this decade or in the early 2030s.

To encourage EV purchases, the Canadian government invests $2 billion in the Incentive for Zero Emission Vehicle Program (iZEV), which provides up to $5,000 in incentives for new EV purchases. With provincial and territorial incentives, some ZEV prices are comparable to gasoline and diesel vehicles.

ZEVs have lower operating and maintenance costs, making them cheaper to own than gas-powered vehicles. They have fewer moving parts, don’t require oil changes or tune-ups, and lack spark plugs and air filters that need replacing.

The Canadian Automobile Association (CAA) estimates maintenance cost savings of 40 to 50 percent compared to gas-powered vehicles. Furthermore, while the annual cost of fueling a gas-powered vehicle can be around $3,000, the annual cost for electricity for an EV is just a few hundred dollars.

Canadians are expected to save about $36.7 billion in energy costs between now and 2050 as a result of these regulations.

Health and Environmental Impacts

The transition to ZEVs will bring significant health benefits by reducing air pollution, which contributes to approximately 1,200 premature deaths and millions of non-fatal health problems annually in Canada, costing an estimated $9.5 billion each year.

By 2050, these regulations are projected to reduce air pollutant emissions. This includes a 36 percent reduction in fine particulate matter (PM2.5), 50 percent in nitrogen oxide (NOx), 61 percent in volatile organic compounds (VOCs), and 68 percent in carbon monoxide (CO).

Charging Infrastructure

Canada aims to expand its charging infrastructure, and technologies are being enhanced. The ZEV targets will prompt private sector investment in charging infrastructure.

Canada has already committed to over 43,000 chargers nationwide, more than doubling the existing number of public charging stations. Quebec ($514 million), British Columbia ($26 million), and Ontario ($91 million) have announced investments to boost charger availability.

Recently, several automakers announced a collaboration to build a network of at least 30,000 DC fast chargers. Most manufacturers will transition to the North American Charging Standard (NACS) port, improving consumer access to charging.

Rural and Northern Considerations

The government acknowledges concerns about charging accessibility in rural and northern communities and the performance of EV batteries in cold weather.

ZEVs can operate in cold climates; for example, Norway’s market share of ZEVs, is nearly 90 percent. PHEVs can be a suitable option in areas where ZEV infrastructure is still developing.

Climate Goal Contribution

The regulations are designed to support Canada’s climate change goals. They are projected to prevent 362 megatonnes of cumulative greenhouse gas emissions. With approximately $96 billion in monetized benefits from reducing these emissions and $36.7 billion in reduced energy costs, the total estimated net benefit is $78.6 billion.

ZEV Compliance Flexibilities

The regulations have a credit system to provide flexibility. Companies exceeding their ZEV targets accrue credits, while those falling short face deficits. The standard includes:

- Early Action Credits (EACs) are available for ZEV sales in 2024 and 2025.

- Credits are available for investments in fast-charging infrastructure.

- Credits are generated for battery electric vehicles, fuel cell electric vehicles, and PHEVs.

Building a Canadian EV Supply Chain

Canada is investing in a robust EV supply chain, including manufacturing, component production, critical minerals, and battery acquisition. Since 2020, the country has secured over $34 billion in supply chain investments.

These include investments in new battery manufacturing facilities in multiple provinces, creating thousands of jobs. Several critical mineral projects have recently received regulatory approval, which will help to fuel the EV industry.