plugin vehicles in China experienced another record-breaking month to conclude the year, marking a 46% year-over-year (YoY) increase in December, reaching a new high of 1,379,000 units. Full electric vehicles (BEVs) accounted for 55% of the plugin market in December, which is 8% below the December 2023 result, with the final 2024 figure at 52% for BEVs.

In terms of market share, plugins achieved a 53% share in December, with BEVs alone contributing 29%. The year 2024 ended with plugins holding a 48% share, and BEVs at 25%. Over the past few years, the growth in plugin share has been significantly driven by PHEVs, as BEVs appear to be plateauing at around 20%.

At the close of 2020, the market share was 6.3% (with BEVs at 5.1%), increasing to 15% (with BEVs at 12%) in 2021, and 30% (with BEVs at 22%) in 2022. Furthermore, 2023 recorded a 37% share (25% BEV), and 2024 concluded with 48% (25% BEV). This implies that while BEVs have seen a 3% rise in market share since 2022, PHEVs have surged from 8% to 23% during the same period. Given that plugins already command a 48% share in 2024, with BEVs alone representing 25%, a slowdown in the growth rate of plugins is expected.

However, even with slower rates, the Chinese automotive market, the world’s largest, is projected to surpass the 50% mark in 2025—ideally, with BEVs still leading the charge. If Chinese automakers aim to double their sales, as many have planned, export will be the key.

In the overall rankings, the top four positions were dominated by plugins. The Tesla Model Y was the best-selling non-BYD model, securing the second position. The BYD Seagull showed the most significant progress, climbing from 10th in 2023 to 4th in 2024. The best-selling ICE (internal combustion engine) model was the Nissan Sylphy, finishing in 5th. In 2024, four fossil fuel models were in the top 10, with all being sedans and three of the four being compact sedans. This segment is becoming the last stronghold for ICE vehicles in China.

Looking at the final results by category, plugins dominate the podium in all but the C segment (compact cars). In the C segment, the top two positions are held by ICE models. This could be a temporary situation. BYD’s Yuan Plus remains strong, while the Geely Galaxy E5 is still in the ramp-up phase, as is the BYD Seal 06 GT. The upcoming BYD Sealion 05 EV will likely make a significant impact.

December 2024 Highlights

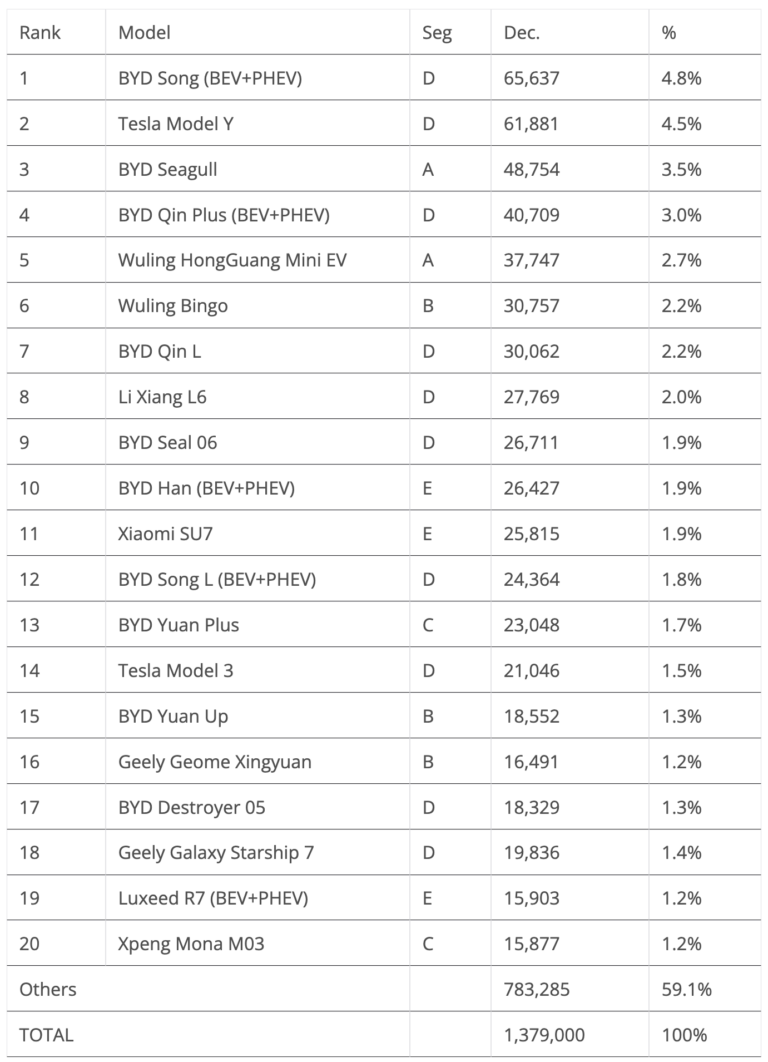

The key news for December 2024 was the BYD Seagull claiming third place, surpassing the Qin Plus. The BYD Song (BEV+PHEV) continued its reign as the best seller, closely followed by its main rival, the Tesla Model Y.

Here’s more on December’s top 5 best-selling models:

1. BYD Song (PHEV+BEV)

The BYD Song’s performance as a midsize SUV is noteworthy, with 65,637 units sold in December. The current generation seems unfazed by the competition from its newer siblings. The Song’s continued dominance depends on the competition, including internal rivalry. Despite more competitors, the Song consistently sells over 50,000–60,000 units monthly, crucial for leading the competitive Chinese auto market. Thanks to its competitive pricing (and an upcoming refresh?), the Song is set to maintain its success.

2. Tesla Model Y

The popular Tesla model registered 61,881 units last month, a 5% increase from the same month last year. This result is notable, with increasing external competition and the potential impact of the upcoming Model Y refresh. Given the strong results and anticipation of the refresh, the crossover is expected to continue performing well in China. With the BYD Song possibly seeing its sales impacted by its siblings, Tesla’s crossover is expected to dominate in 2025, even if its sales don’t increase significantly.

3. BYD Seagull

December saw BYD’s smallest star register 48,754 units—but this was not a record month. This implies that the delivery ramp-up is slowing down, at least for now. The biggest impact of this EV will be in export numbers, where many markets are aiming for small and affordable EVs. This little hatchback is set to become a regular on the podium in China and globally. Competitive pricing and specs drive its success.

4. BYD Qin Plus (BEV+PHEV)

A consistent performer in the BYD lineup, the Qin Plus reached 40,709 registrations last month. Expect the midsize model to compete for top 5 positions throughout 2025. Thanks to its exceptional value for money, this model leads its vehicle class (midsize sedans). This is a key factor contributing to the success of the Chinese EV industry and BYD, in particular.

5. Wuling Mini EV

The small car has returned to its former glory. It returned to the top 5 due to a refresh. In December, it had 37,747 sales, its best in over two years. With a 5-door version soon available, expect its sales to continue climbing. It will be interesting to see whether it can challenge the market leader, the BYD Seagull.

Analyzing the rest of the December best-seller table, several models hit their best-ever scores in December. The #6 Wuling Bingo deserves a mention, and the Wuling EV managed to overcome the BYD competition in its segment. The #8 Li Xiang L6 (27,769 registrations) also deserves recognition, with the midsize SUV continuing to increase production. In the second half of the table, the #11 Xiaomi SU7 is ramping up, with a record 25,815 units delivered. This surpassed the Tesla Model 3 (#14, with 21,046 units) in a peak Tesla month. Xiaomi’s sports sedan will be a powerful contender to displace BYD’s flagship sedan in 2025.

Elsewhere, the #18 Geely Galaxy Starship 7 debuted with 19,836 units sold, marking an impressive landing in automotive market history. The #19 Luxeed R7 entered the top 20 in just its second month, due to 15,903 sales of the big crossover, and the highly anticipated Xpeng Mona M03 debuted on the table with 15,877 sales.

Outside the top 20, some surprises included the new Deepal S05—a subcompact crossover that saw record sales of 11,922. On the startup front, the Xpeng P7+ had a strong result, with 10,034 units delivered in its second month.

Top Selling EVs in China — January–December 2024

Looking at the 2023 ranking, the BYD Song repeated its success of the past two years, finishing as the best seller. The Song ended with more than 200,000 units above the runner-up, the Tesla Model Y. The Tesla Model Y surpassed the BYD Qin Plus in the last phase of the 2024 race, allowing the Tesla crossover to win its third silver medal. (It won bronze in 2022.)

BYD had a strong performance, with seven models in the top nine positions. They also won three size categories in the overall market. Expect BYD’s dominance to be more contested in 2025, as competition increases.

Changes in the Overall Brand Ranking In 2024, the podium remained the same. The rise of leader BYD continued, growing 37% compared to 2023. Volkswagen and Toyota remained in the same positions, while Geely improved from #5 in 2023 to #4 in 2024. Geely is predicted to continue its rise.

With the opposite dynamic, #5 Honda lost a position in 2024 and could lose more in 2025, as Wuling, Chery, and even Tesla could surpass it. Another legacy OEM that has been struggling is BMW. It was 10th in 2024 (compared to 7th in 2023) after a 13% drop in sales.

For some brands to go down, others are rising, such as AITO, Leapmotor, and Zeekr. Looking at the brand EV ranking, BYD won its 4th title in a row (and 11th overall), but did lose some share compared to 2023 (33.8% in 2023 vs. 32.5% in 2024). Is this the peak for BYD? Since they started making plugins in 2008, the Shenzhen-based automaker always ended among the top two positions in the top manufacturers table in China.

Meanwhile, Tesla won its second silver medal in 2023, with 6% share. This was a 1.5% drop in market share. Wuling won the bronze, ending in 3rd with 5.3% share. Li Auto ended the year in 4th, with 4.6% share, just ahead of Geely, which ended the year with 4.5% share. As such, 2025 could be the breakout year, and a podium position may be attainable.

BYD was also the big winner by automotive EV group, with a small drop in share. Expect the following years to be the same story, as BYD continues to dominate. As for Geely’s runner-up spot, the Chinese OEM is continuing its upward trend. The question mark is the last position on the podium. Tesla won it, with 6% share, but SAIC and Changan could have a hard time to keep Tesla off the podium in 2025.