How Innovative Is China in the Electric Vehicle and Battery Industries?

China has emerged as a global leader in the electric vehicle (EV) and EV battery industries. Their firms produce a massive share of the world’s EVs and batteries, and have driven innovation in EV products, processes, and customer experiences. This article will explore the dynamics of this sector.

Key Takeaways

- Chinese automakers produce a significant portion of the world’s passenger vehicles, a figure expected to grow substantially in the coming years. They accounted for most of the world’s EVs and EV batteries as of 2022.

- China’s EV exports have shown massive growth, with a large portion going to Europe.

- Chinese EV and battery companies are innovating at a rapid pace, challenging their Western counterparts in areas like product quality and research output.

- Chinese EV companies are faster at developing and releasing new car models than established American, European, and Japanese automakers.

- Institutions in China are responsible for the majority of high-impact research publications in electric batteries, significantly outpacing the United States.

- The global share of patents in the field of electric propulsion held by Chinese entities has increased dramatically.

- China’s EV and battery manufacturers have benefitted from substantial government support, local content requirements, and intellectual property (IP) practices.

- America’s long-term response to China’s EV dominance should include investments in R&D, stimulating EV adoption, and defensive trade measures.

Introduction

In 1985, Chinese enterprises manufactured a total of 5,200 passenger vehicles. In 2024, that number is predicted to reach 26.8 million—21 percent of global production—and is expected to climb to one-third by 2030. The number of EV manufacturers in China is over 200, and they are expected to produce an estimated 10 million EV units in 2024. This is a significant increase from 8.9 million vehicles in 2023. In 2022, China produced 62 percent of global EV production (even accounting for Western manufacturers operating in China, like Tesla) and 59 percent of global EV sales. Similarly, China’s battery manufacturing capacity in 2022 was 0.9 terawatt hours, which is about 77 percent of the global share.

As the Wall Street Journal’s Greg Ip noted, China’s global lead in EVs relies on a combination of “industrial policy, protectionism, and homegrown competitive dynamism.” It is undeniable that China’s EV industry has benefitted from assertive industrial policy, particularly from government subsidies to the sector, which totaled over $230 billion from 2009 to 2023. These subsidies were primarily in the form of buyer’s rebates and sales tax exemptions. Chinese EV and EV battery companies have benefitted from other policies as well, such as local content requirements, forced technology transfers, and state-supported IP theft.

These companies have also benefitted from public research and development (R&D) investments in EVs, government procurement policies, the development of charging infrastructure, and consumer incentives. The Chinese government has made EV competitiveness a national priority, and it recognized that Chinese businesses were unlikely to become globally competitive in internal combustion engines (ICE). This is why Chinese leaders identified EVs as a breakthrough, or “leapfrog,” technology that would allow the country to develop a globally competitive domestic industry while reducing dependence on foreign automotive technologies and ICE automobiles. As one industry observer explained, “The primary motivation for China to push for EVs was energy security. Second was industrial competitiveness, and a far distant third was sustainability.”

Today, China’s push toward leadership in EVs should be viewed as an attempt to accumulate and expand its national power. Chinese EV and EV battery enterprises have become more innovative in product, process, business model, and customer experience innovation. Chinese enterprises are at the forefront of battery chemistry breakthroughs, with the aim of developing EV batteries that will have a 2,000-kilometer (km) range. The battery can account for as much as 40 percent of the value of an EV, giving the country’s EV manufacturers an important advantage.

Chinese enterprises are leading in other aspects of vehicle technology, from innovative vehicle suspension systems to the incorporation of digital features. These include autonomous driving, interactive voice control to multiple touch screens that allow everything from watching movies to singing karaoke. They are also aggressively innovating vehicle production processes, from robotic automation to digital production systems. One report finds that Chinese EV companies are 30 percent faster in developing and releasing new car models than American, European, and Japanese carmakers.

Leading Chinese manufacturers such as BYD, Li Auto, and Xiaomi increasingly rival or exceed offerings from Tesla or BMW. These companies are supported by a capable ecosystem. Notably, the number and quality of Chinese scientific publications related to EVs and EV batteries has increased in recent years. For instance, the Australian Strategic Policy Institute (ASPI) found that Chinese institutions account for a vast majority of the high-impact publications for electric batteries, far surpassing U.S. institutions. Chinese entities’ global share of patents in the field of electric propulsion increased from 2.4 percent in 2010 to 26.9 percent in 2020. BYD, Xiaomi, and others are becoming critical global players in the sector, and a long-term threat to established auto manufacturers.

In response, the United States has introduced tariffs of 100 percent on Chinese EVs, and the European Union has established tariffs of up to 38 percent. The leading OECD nations will need to double down on technological innovation. Policymakers should support the sector with robust R&D funding, programs such as a “BatteryShot,” and policies to stimulate adoption. Policymakers must recognize that green technologies will only become attractive to buyers once they reach price/performance parity.

Background and Methodology

The common narrative is that China is a copier and the United States is an innovator. This assumption supports a complacent attitude toward U.S. technology and industrial policy. To determine how innovative Chinese enterprises and industries are, the Smith Richardson Foundation provided support to the Information Technology and Innovation Foundation (ITIF) to research the question. ITIF focused on particular sectors, including EVs and their batteries.

It is difficult to assess the innovation capabilities of any country’s industries, particularly Chinese industries. Under President Xi Jinping, China discloses less information to the world than it used to. ITIF relied on three methods: case study evaluations of two Chinese EV companies, interviews and a focus group roundtable with global experts, and assessment of global data on EV innovation, including scientific articles and patents.

Importance of EVs and EV Batteries and the U.S. Role

Concerns over climate change have prompted governments to focus on alternative energy sources. EVs, and their associated battery technologies, have gained importance. Various governments have adopted strategies to encourage investment in and adoption of EVs to reduce greenhouse gas (GHG) emissions. For example, between the 2021 Infrastructure Investment and Jobs Act and the Inflation Reduction Act, the U.S. Congress has allocated over $245 billion in public expenditures toward supporting EV development and adoption.

EVs have existed longer than most realize. U.S. inventor William Morrison invented the first operational EV in 1890. Interest arguably started in the 1970s with the rise in oil prices and gas shortages, which motivated Congress to pass the Electric and Hybrid Vehicle Research, Development, and Demonstration Act of 1976.

Lithium iron phosphate (LFP) battery technology originated in the United States, but companies “abandoned it for lack of a near-term payback.” The technology was commercialized in Japan in the 1990s and dominated by Japanese and South Korean manufacturers. However, it has been improved over the past two decades by several Chinese companies, including CATL and BYD.

Tesla has become an important American innovator in EV and EV battery technology, along with others such as Rivian and Lucid Technology, as well as traditional manufacturers including Ford and General Motors (GM). While the United States has fallen off the global lead in EV battery production, several innovative start-ups, including QuantumScape, are trying to develop a next generation of “all-solid-state batteries” (ASSBs) that would reestablish an American foothold in the field.

A healthy automotive sector is critical to the U.S. economy. The sector has historically contributed from 3 to 3.5 percent of overall U.S. gross domestic product (GDP). The industry supports 9.7 million American jobs, which is roughly 5 percent of private sector employment. The U.S. automotive industry is simply too big to fail if the United States is to have a robust manufacturing sector and vibrant advanced-technology economy.

China’s Electric Vehicle Industry

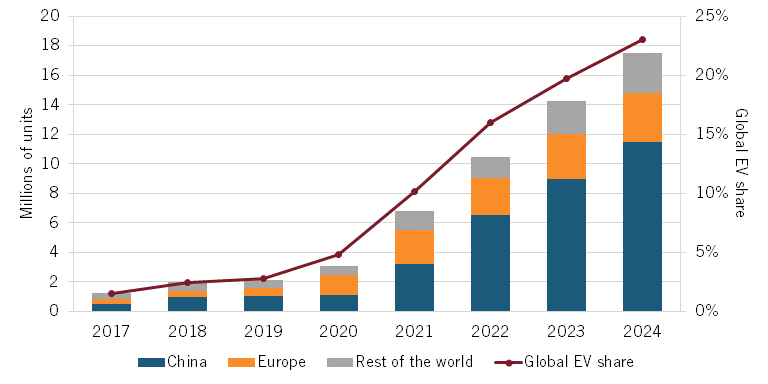

Several types of new energy vehicles (NEVs) exist, including fully battery electric vehicles (BEVs), plug-in hybrid electric vehicles (PHEVs), and hybrid-electric vehicles (HEVs). By year-end 2024, BEVs and PHEVs are expected to account for 21.8 percent of all new vehicles sold globally, an increase of 2 percentage points from the 19.2 percent in 2023.

China has become dominant in both EV production and sales. Analysts expect that 11.5 million new EVs will be sold in China in 2024 (compared with 3.3 million in Europe and 2.7 million across the rest of the world), which will account for 44 percent of new vehicles sold in the country this year. In 2023, sales of EVs in China increased by 37 percent from the year prior. In December 2023, China accounted for 69 percent of the world’s EV sales for that month. By 2030, analysts expect EVs to account for over 70 percent of annual vehicle sales in China.

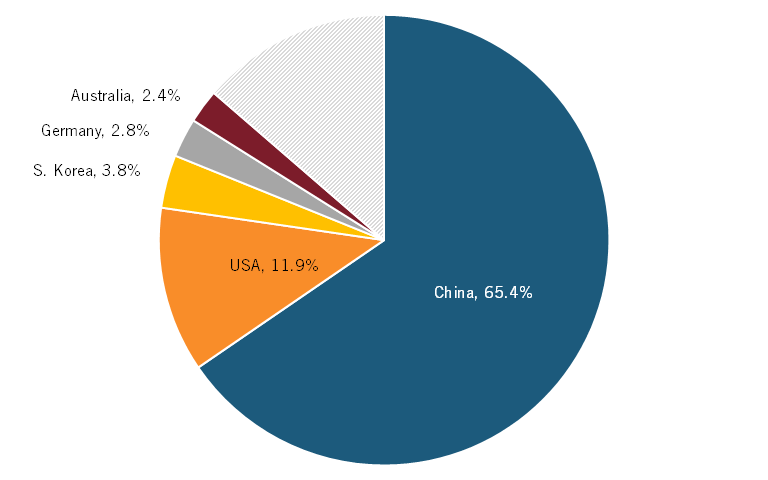

Chinese enterprises have become leading players in the global EV industry. Chinese manufacturers accounted for 62 percent of all EVs produced in the world as of 2022, an increase from the 0.1 percent in 2012. In 2023, China’s total NEV production reached 8.91 million units, up 34.2 percent over the previous year, and analysts expect China’s total NEV production will exceed 10 million units in 2024. For 2023, China produced 6.11 million BEVs and 2.8 million PHEVs.

Figure 1. EV sales by country and EVs as a share of all car sales.

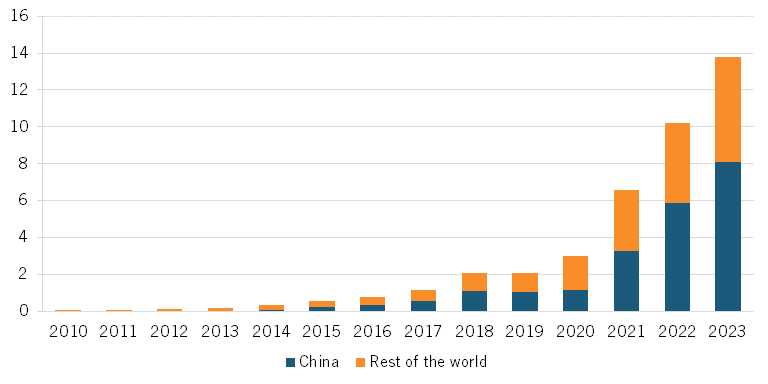

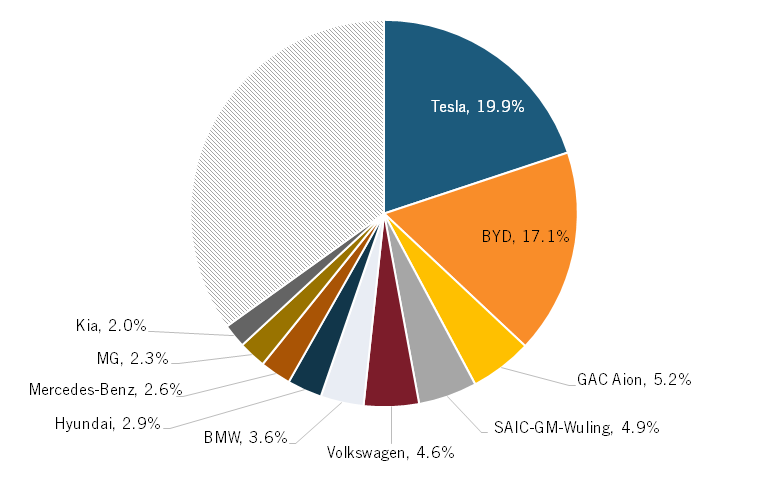

According to the market research firm TrendForce, as of year-end 2023, Tesla commanded 19.9 percent of the global BEV market, followed by Chinese firms BYD with 17 percent, GAC Aion with 5.2 percent, SAIC-GM-Wuling with 4.9 percent, and Volkswagen with 4.6 percent. Based on Q1 and Q2 2024 production, analysts expect that BYD will surpass Tesla as the top producer of BEVs by year-end 2024.

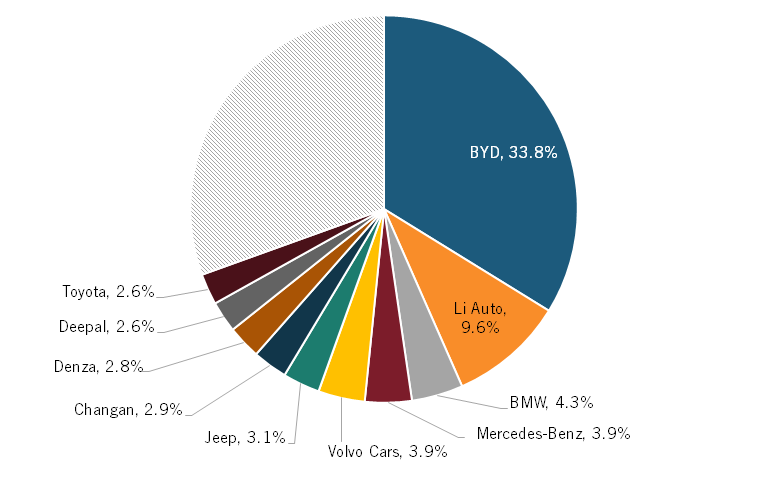

Considering PHEVs only, BYD dominates the global industry, with a 33.8 percent market share, followed at the top by Chinese firm Li Auto with 9.6 percent.

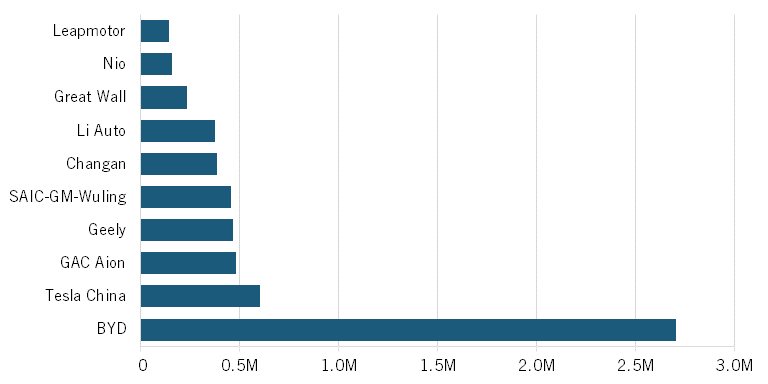

In terms of the Chinese NEV retail sales market specifically, BYD sold 2.76 million vehicles in 2023, followed by Tesla China with 603,664 vehicles sold and GAC Aion with 483,632. Overall, BYD accounted for 35 percent of Chinese NEV sales in 2023.

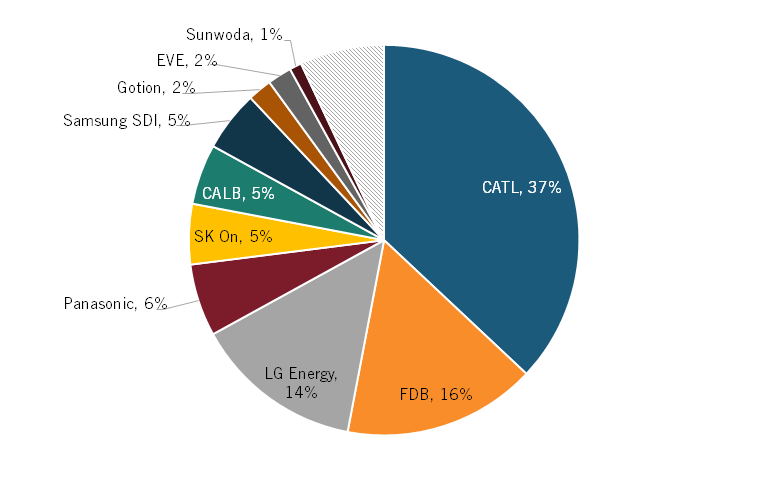

Likewise, Chinese enterprises dominate in the global share of EV battery manufacturing. CATL accounts for 37 percent of the global EV battery market followed by FDB with 16 percent. In total, Chinese EV battery manufacturers hold about 75 percent of the global market. Morgan Stanley analysts predict that, by 2030, CATL alone will account for 35 percent of batteries sold in the European market.

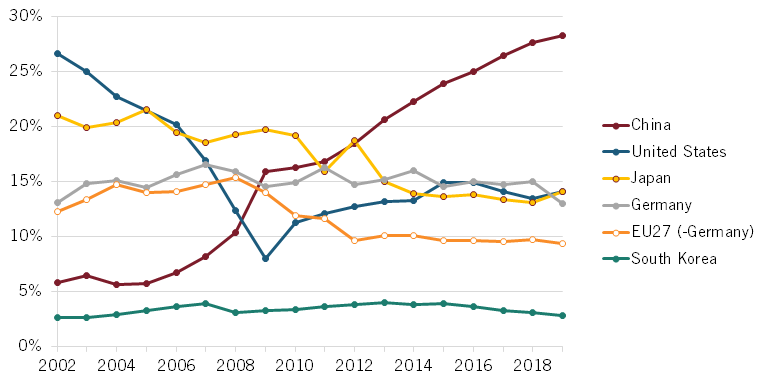

The U.S. National Science Foundation (NSF) finds that China’s share of value added in the automotive industry increased nearly fivefold from 6 percent in 2002 to roughly 28 percent by 2019.

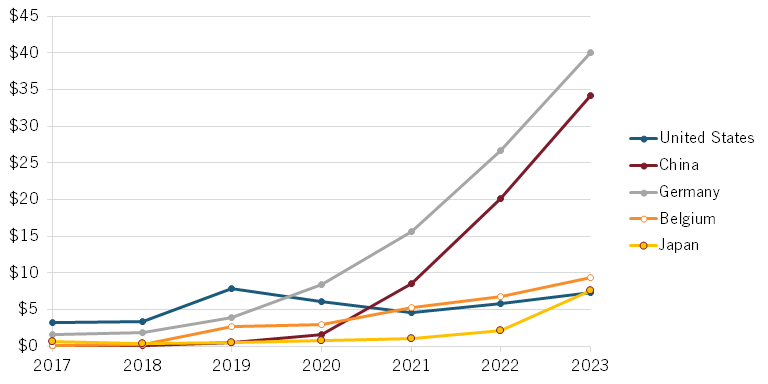

China has become the leading global exporter of vehicles. Chinese BEV exports rose 70 percent in 2023, reaching $34.1 billion in value. Chinese producers accounted for approximately 35 percent of global EV exports as of year-end 2022. From 2000 to 2023, Chinese EV exports increased over 850 percent. Forty percent of Chinese BEV exports are destined for European markets.

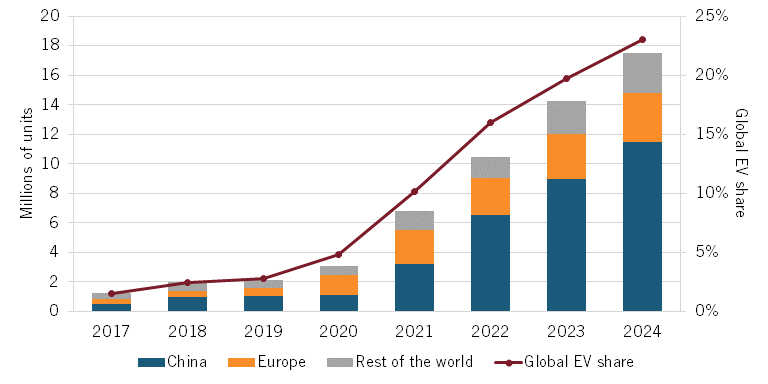

Figure 2: Global EV sales in millions of units.

Analysts predict that Chinese carmakers will capture one-third of the global auto vehicle market by the end of this decade. Chinese carmaker BYD has commissioned construction of a fleet of eight car carriers to underpin its global EV expansion; its BYD Explorer 1 can ship 7,000 vehicles at a time. In total, Chinese automakers are responsible “for almost all of the orders now pending worldwide for 170 car-carrying vessels.”

Western auto manufacturers operating in China still account for a share of EV exports from China. In 2022, Tesla alone accounted for 40 percent of China’s total EV exports.

By value of EV exports, according to United Nations (UN) Comtrade data, Germany retains a slight edge over China. As of 2022, Germany remained the leading exporter of EVs, by value, with a 28.5 percent share, but China placed second at 18.6 percent.

Figure 3: Global market shares of top 10 BEV manufacturers, year-end 2023.

Figure 4: Global market shares of top 10 PHEV manufacturers, year-end 2023.

Figure 5: Top 10 manufacturers’ NEV retail sales in China, 2023.

Figure 6: Leading EV battery manufacturers’ global market shares, 2023.

Figure 7: Global shares of value added in the motor vehicles, trailers, and semi-trailers industry.

How Innovative Are China’s EV and EV Batteries Industries?

Chinese enterprises have become highly competitive and innovative players in the global EV and battery industries. Commentators at an ITIF roundtable of experts on China’s EV industry observed that Chinese enterprises are very innovative, especially in EVs. When asked about rival BYD’s prospects, Tesla CEO Elon Musk commented, “Have you seen their car? … I don’t believe they offer a superior product.” When asked the same question during a June 2024 analyst call, Musk responded, “Our observation is, generally, that the Chinese car companies are the most competitive car companies in the world.” Enterprises can pursue various types of innovation, including product, process, business model, and customer experience innovation. The following section analyzes how innovative Chinese EV and battery makers are along these different innovation trajectories.

Product Innovation

This section examines Chinese enterprises’ innovations with regard to both the batteries powering the EVs and product innovations across the rest of the vehicle.

EV Battery Innovation

Batteries account for about 40 percent of the value of an EV. A wide range of EV batteries exist, with the two most prominent types being LFP and nickel and cobalt-based batteries. Nickel/cobalt batteries have tended to be more popular in American- and European-produced EVs. In contrast, LFP batteries represent an older battery chemistry that tends to cost less, have a longer life cycle, and be safer. However, from 2016 to 2018, LFP batteries accounted for just 10 percent of the global EV battery market. Chinese companies, particularly CATL, changed this consensus through advanced research.

In February 2023, Ford announced it would invest $3.5 billion to build an LFP plant, licensing “battery cell knowledge and services provided by CATL.” In April 2024, CATL announced that it had developed its fast-charging “Shenxing Plus” LFP battery, which is capable of a driving range of more than 1,000 km (621 miles) off a single charge. CATL asserts that the battery can achieve a range of 400 km off just a 10-minute charge. In June 2023, another Chinese EV battery maker, Shenzhen-based Gotion High-Tech. Co. announced it had designed a lithium-iron-manganese phosphate (LFMP) battery also capable of a 1,000 km range off a single charge.

Figure 8: Exports, by value, of top five EV-exporting nations ($ billions)

EV battery technology continues to evolve, and the next generation of EV batteries is expected to be ASSBs. Unlike lithium-ion batteries, which use liquid electrolytes, solid-state batteries employ a solid electrolyte, which can provide a higher energy density.

In December 2023, Chinese EV maker Nio unveiled its ET7 sedan with a semi-solid state, 150 kWh battery made by Chinese battery company WeLion, which can travel 650 miles on a single charge. In April 2024, Chinese automaker GAC group asserted it had developed an ASSB capable of 620 miles per charge that would be production ready for its Hyper vehicles by 2026. Companies such as CATL, GAC, Tailan, and WeLion seem likely to keep Chinese firms at the forefront of global EV battery innovation.

One reason China’s EV battery makers (and thus EV car makers) have been able to innovate so rapidly and cost-effectively in this space pertains largely to the country’s dominance over the supply chain. For instance, China mines over two-thirds of the world’s graphite and 18 percent of its lithium. Regarding raw materials processing and refining, China in 2023, refined 95 percent of the world’s manganese.

EV Innovation

Chinese EV makers have intensely focused on innovating beyond the battery itself, incorporating digital features into the vehicle, such as autonomous driving, driver-assistance features, navigational aids, and virtual reality. Modern vehicles rely increasingly on digital technology, and the contribution of electronics and digital technologies to a vehicle’s cost has increased from just 18 percent in 2000 to over 40 percent today.

In May 2024, XPeng Motors said it intends to introduce its AI-powered in-car operating system (the XOS 5.1.0), with the aim of delivering full autonomous driving (Level 4) in China by 2025. In April 2024, Xiaomi, which only entered the auto industry in 2021, became China’s eighth-largest EV manufacturer after selling more than 7,000 units of its first model, the Xiaomi SU7.

To save on time and costs, Xiaomi adopted practices from Tesla and other automakers. Xiaomi had to innovate. The liquid aluminum that gets injected into the die-casting machine has to be a certain variety that can withstand an extraordinary amount of pressure.

Chinese EV makers are innovating many other vehicle features aside from electrification and digital features. For instance, in 2023, Yangwang introduced its DiSus-X suspension technology, which enables its quad-motor EV, the U9, to drive on only three wheels.

Figure 9: New and updated EV releases in China, 2017–2023.

Other Vehicle Innovations

China’s carmakers aren’t innovating only EVs. For instance, in June 2022, a team of researchers from 42 companies and three universities unveiled the Tianjin solar car, which its developers touted as “the country’s first smart vehicle to be powered solely by the sun.” Elsewhere, Chinese start-up AutoFlight has developed a proof-of-concept electrical-vertical-takeoff-and-landing air taxi.

Process Innovation

Process innovation is the development and implementation of new or improved processes, methods, or systems to enhance efficiency. Chinese EV makers seem strong at process innovation, particularly accelerating speed to market. As one article explains, “Chinese EV companies heavily use simulation software to create virtual prototypes and run tests.” In 2023, Chinese enterprises deployed more industrial robots than did firms across the rest of the world combined. Chinese EV manufacturers are also devout adopters of a process pioneered by Tesla: leveraging software to update vehicle features.

Another factor contributing to Chinese EV makers’ rapid time to market is the depth of the supplier ecosystem within China. Chinese EV manufacturers are willing to substitute traditional suppliers for smaller, faster ones. Lastly, it’s important to note that Chinese EV makers are using automation processes to the maximum extent possible.

Market- and Customer-Experience-Driven Innovation

Chinese EV industry analysts have also spotlighted the industry’s use of additional innovation strategies worth mentioning. Chinese EV makers initially experimented with EV battery technologies in adjacent industries. They recognized that taxi operators required charging schedules. Chinese EV makers tend to be much more attuned to customer desires in the Chinese marketplace.

Innovation Inputs to China’s EV Sector

This section examines indicators assessing China’s EV competitiveness at the industry level, considering such factors as R&D intensity, scientific publications, and patenting levels.

R&D Intensity

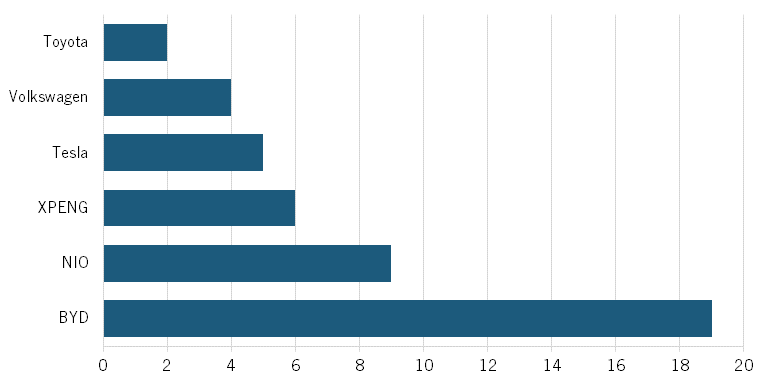

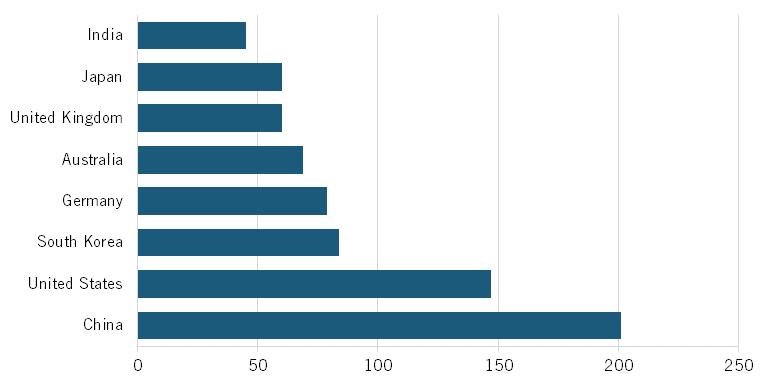

In terms of automotive companies’ levels of R&D investments (as reported in the “2023 EU Industrial R&D Investment Scoreboard”), China places 8 of the top 15 in the study. Nio and XPeng were the leading Chinese companies.

Table 1: Leading automotive R&D investors in the 2023 EU Industrial R&D Investment Scoreboard.

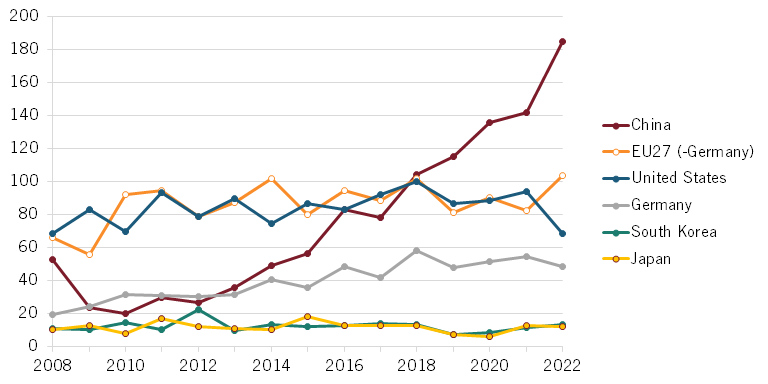

Scientific Publications

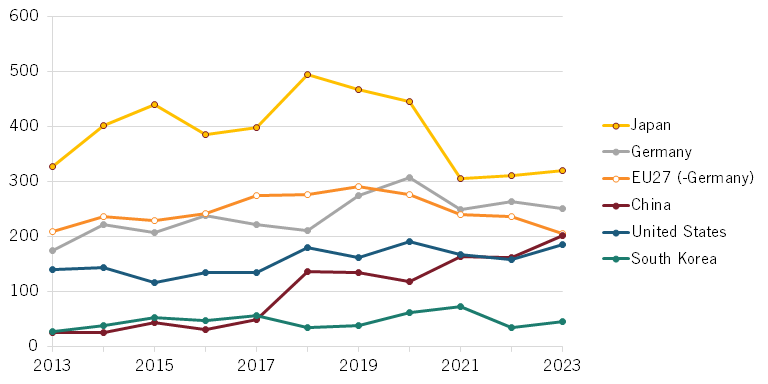

In 2021, Chinese institutions surpassed European ones in producing the most top-10 percent-cited publications in automotive engineering. The number of Chinese scientific publications regarding EV research began to significantly accelerate around 2011.

Figure 10: Number of automotive engineering publications in top 10 percent of most-cited publications.

Figure 11: Number of EV scientific publications in China (per trillion $ GDP).

Figure 12: Top five countries for high-impact publications about electric batteries in the ASPI Critical Technology Tracker dataset.

Figure 13: H-Index for scientific publications in electric batteries, 2023.

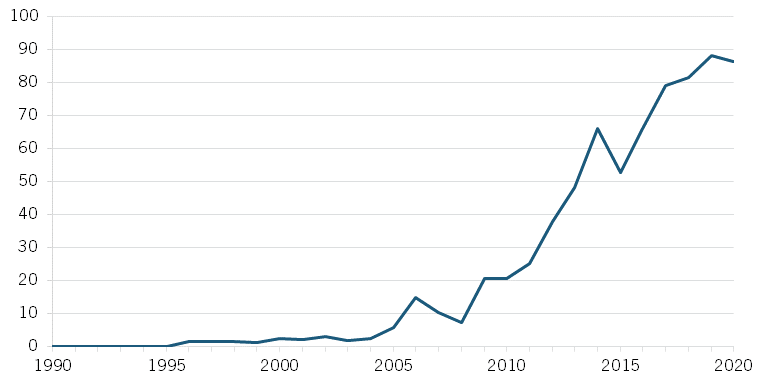

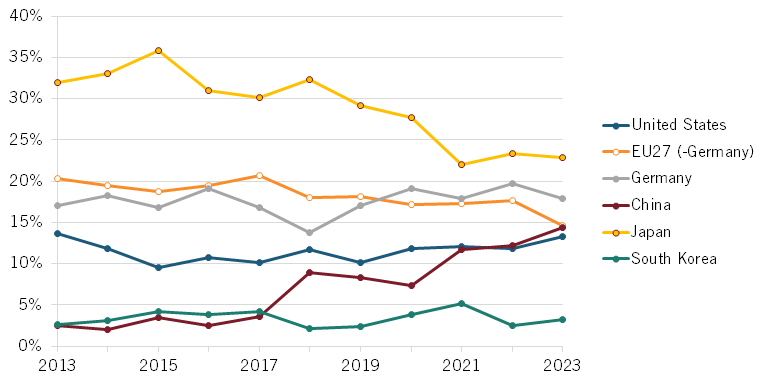

Patents

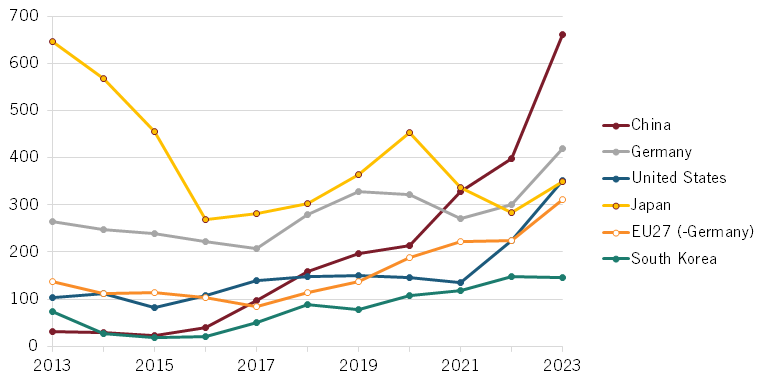

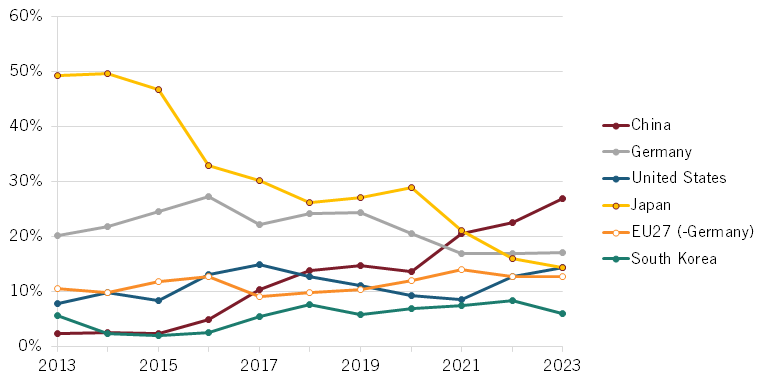

China’s number of Patent Cooperation Treaty (PCT) patent publications in motor vehicle technologies increased dramatically. When considering global shares of PCT patent publications, China’s global share increased between 2013 and 2023. China’s share increased from 2.4 percent in 2010 to 26.9 percent in 2020.

Figure 14: Number of PCT patent publications in motor vehicles (B62D).

Figure 15: Global shares of PCT patent publications in motor vehicles (B62D)

Figure 16: Number of PCT patent publications in electric propulsion technology (B60L)

Company Case Studies

This section provides case study analyses of two Chinese EV companies: BYD and Li Auto.

BYD

BYD was founded in 1995. BYD entered the automotive sector through the acquisition of Qinchuan Automobile in 2003. BYD’s initial focus was manufacturing batteries for ICE vehicles, although the company manufactured its first PHEV in 2008. In 2023, BYD became the world’s largest manufacturer of EVs. In FY 2023, BYD’s revenues reached 602 billion yuan ($82 billion), with EVs accounting for approximately 70 percent. In 2020, BYD launched its long-range Blade LFP battery, which is less prone to combustion.

BYD has received recognition for its industry innovation and leadership. BYD’s R&D team comprised 69,700 personnel in 2023 and is a “privately-owned” company. From 2017 to 2022, BYD received government subsidies amounting to approximately $4.175 billion for NEV purchases.

Li Auto

Founded in 2015, Li Auto is an NEV company specializing in the design, development, manufacturing, and sale of EVs, particularly PHEVs. In 2023, Li Auto sold 376,030 vehicles, placing it as China’s seventh-largest EV maker. Li Auto has been developing technologies such as EREV4 Powertrain, BEV technologies, and autonomous driving. Li Auto’s R&D investments reached 1.3 billion yuan ($193 million) in 2022. Li Auto was the first Chinese automaker to receive the world’s highest MSCI ESG global “AAA” rating.

China’s Government Policies Supporting the EV Sector

It is undeniable that China’s current leadership in EVs and EV batteries stems from a strategy and industrial policies. The Chinese government began investing in EV-related technologies as early as 2001. China’s support has been instrumental in advancing China’s EV industry, from setting strategic direction to financing R&D.

Subsidies

Subsidies have been the most substantial factor. Estimates indicate that, from 2009 to 2023, China channeled $230.9 billion in subsidies to its domestic EV sector. Five forms of subsidy support exist: nationally approved buyer rebates, exemption from the 10 percent sales tax, government funding for infrastructure, R&D programs, and government procurement of EVs. Buyer’s rebates accounted for 62 percent of the Chinese government’s support, but with the Chinese government reducing the buyer’s rebate, the largest form of support in 2023 came from sales tax exemptions.

A key reason why Chinese subsidies are so pernicious is that they enable Chinese companies to sustain themselves in industries where they wouldn’t be able to subsist if they had to earn market-based rates of return.

Local governments have played a key role in propping up uncompetitive firms and contributing to overcapacity in the sector. Local governments have given auto manufacturers nearly free land, loans at near-zero interest, and other subsidies.

JVs and Technology Transfer Requirements

China has long employed a practice called “trading technology for market,” conditioning foreign companies’ access to markets of technology and IP. Over time, China’s approach to attracting foreign direct investment evolved from attraction to compulsion.

IP Theft

Whatever EV IP or technologies Chinese entities can’t acquire by enticing foreign enterprises to barter away, China seeks to acquire through state-sanctioned IP theft. U.S. EV companies are feeling the brunt of coordinated Chinese efforts to pilfer their technology.

Favoring Domestic Enterprises

The Chinese government has long worked to favor domestic over foreign suppliers in automotive supply chains. The “Made in China 2025” strategy stipulated that more than 70 percent of the one million-plus EVs sold annually in China should be from homegrown brands by 2020.

Other Policies

Some policies have been designed to promote innovation or adoption of these technologies. China directed an estimated $25 billion toward R&D activities in its EV industry from 2009 to 2023. Shanghai authorities have long offered EV owners license plates at no cost. China has also established the world’s largest public charging infrastructure network. Active government procurement of EVs has also played an important role.

Analysis of Chinese Policies Supporting the EV Sector

Should China’s success with EVs be viewed as beneficial? While Chinese EV makers have demonstrated some degree of innovation, the sector benefits from IP theft, industrial subsidization, and practices that distort the economics of the industry and disadvantage foreign automakers.

What Should America Do?

U.S. policy has stimulated EV production and adoption. The Inflation Reduction Act allocated over $245 billion in public expenditures toward EVs. Americans who purchase new EVs may be eligible for a tax credit of up to $7,500. The U.S. Department of the Treasury and Internal Revenue Service announced that American consumers had saved more than $1 billion on clean vehicle purchases. There are continued efforts to push out more charging points through both public and private investment.

It is important to recognize that innovation- and technology-advancing policies, such as investments in research and the development and commercialization of next-generation alternatives, are the best solution. The next administration should launch a “BatteryShot Initiative” with the goal of producing a battery with a total system cost of less than $200/kWh and a range of at least 1,000 miles per charge.

American drivers won’t adopt EVs if they lack confidence in a reliable national EV charging. U.S. government entities should increase their coordination. American (and European and Asian) policymakers should pass legislation that precludes companies from countries of concern, such as China, from marketing their products if that country does not allow similar products from U.S. firms to be sold (and or marketed).

U.S. policy should clarify that EVs and EVs batteries manufactured by Chinese enterprises that have benefitted from IP theft or massive industrial subsidization will pay a 100 percent tariff rate.

The United States must lead an alliance of like-minded nations to build alternative EV battery input supply chains outside of Chinese control. The next administration should invest resources into clean recycling of batteries.

Conclusion

China has become a major player in the global automotive industry. Chinese EV and EV battery enterprises have at least equaled—and in some cases surpassed—their Western peers in innovation capacity and product quality. China’s leadership in EVs began as a result of intentional industrial policy. From that base, Chinese EV players have become increasingly capable, innovative, and competitive.