Japan’s Electric Car Market Projected for Significant Growth

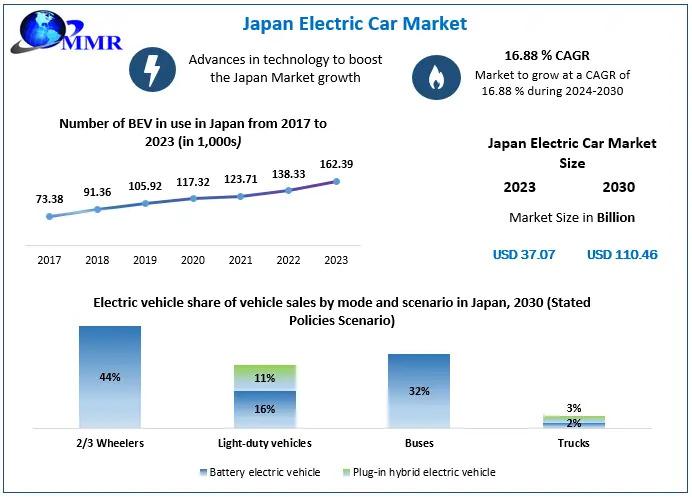

The Japan electric car market is on a trajectory of substantial expansion, fueled by a convergence of government initiatives, ongoing technological progress, and a strong commitment to environmental sustainability. As the global automotive sector undergoes a transformative shift towards electrification, Japan is strategically positioned, leveraging its industrial capabilities and policy frameworks to cultivate considerable growth in the electric vehicle (EV) sector. The market, valued at USD 37.07 billion in 2023, is predicted to witness a robust Compound Annual Growth Rate (CAGR) of 16.88% during the forecast period, reaching an impressive USD 110.46 billion by 2030.

Several key factors are contributing to this substantial growth:

Supportive Government Policies and Incentives

The Japanese government has implemented a suite of measures designed to encourage the adoption of EVs. These include subsidies of up to 800,000 yen (approximately USD 7,000) and tax incentives aimed at reducing the overall cost of electric cars for consumers. Aligning with its goal of achieving carbon neutrality by 2050, Japan is also considering a ban on the sale of gasoline-powered vehicles by the mid-2030s.

Ongoing Technological Advancements

Continuous advancements in battery technology are enhancing energy density while concurrently reducing charging times and lowering costs. These improvements make electric vehicles more practical and appealing to a wider range of consumers. Leading the charge in EV innovation in Japan are numerous automakers, who are actively shaping the future of EVs by integrating cutting-edge technologies.

Growing Environmental Awareness

Increased public awareness of environmental issues is fostering greater demand for cleaner modes of transportation, gradually shifting consumer preferences towards electric vehicles. EVs, recognized for their zero tailpipe emissions, are considered a key solution in mitigating environmental pollution.

US Trends and Investments in 2024

Electric vehicle sales have surged to an unprecedented level in the United States, accounting for 10.6% of all new light-duty vehicle sales in Q3 2024. This is a slight increase from the previous quarter, when EV sales jumped to 9.96%. This growth is a result of various factors including:

-

Investment:

Through October of 2023, the U.S. is expected to draw some $312 billion in EV manufacturing investments, with over 71% ($223 billion) of that total already committed to specific facilities and projects. These investments reflect the nation’s commitment to building a robust and EV-focused supply chain.

-

Variety of Models:

By Q3 2024, 125 EV models were available to consumers, encompassing a diverse range of vehicle types, including passenger cars, utility vehicles, pickup trucks, and vans. This wider selection addresses a broader range of consumer preferences, thereby driving increased EV adoption.

Dominant Segments and Market Segmentation

The Japanese electric car market is segmented by vehicle type, with a focus on segments that generate the highest revenue. The primary segments include:

-

Passenger Vehicles: This category represents the largest segment, driven by growing consumer preference for electric vehicles for personal use. The increasing availability of diverse models across a wide price range has significantly contributed to the rise of EVs.

-

Commercial Vehicles: The commercial EV segment is still in the early stages of development but is exhibiting growth due to urban business applications, with companies increasingly opting for electric fleets to reduce expenses and meet sustainability standards.

Industry Overview: Key Global Players

The global EV market is characterized by intense competition, with major players vying for an increased market share. The principal competitors in terms of market share and recent activities include:

-

Tesla, Inc.: Initially, Tesla experienced a 45% drop in European sales in early 2024, yet continues to be a major force, achieving 11% market share in global EV sales in the first five months of 2024, with 625,596 units sold between January and May of that year. To maintain competitiveness, the business is investing in brand-new technologies to boost auto efficiency.

-

BYD Company Limited: BYD is another leading entity in the global electric vehicle market, securing a substantial market share through its extensive product offerings and competitive pricing. Their innovations in battery technology have provided them with a competitive edge.

-

Volkswagen Group: Volkswagen, a leader in the EV sector, and its brands accounted for 20% of aggregate European armored vehicle sales in 2023. The company has invested $5.8 billion in Rivian to develop cutting-edge EV technology, with new models anticipated by 2027.

-

Stellantis N.V.: Stellantis has more than doubled its proportion of European EV sales, rising from less than 2% of EV sales in 2015 to almost 15% of sales in 2023, a testament to the company’s focus on electrification and investment in new technologies.

-

BMW Group: BMW is extensively investing in their EV lineup, incorporating advanced technologies such as AI, machine learning, and cloud computing to enhance vehicle functionalities and the user experience. As a result, the company has become a leading EV manufacturer.

Regional Analysis

-

United States: The EV market has seen significant growth in the U.S., with EVs accounting for 8.7% of new light-duty vehicle sales in Q4 2024. Governmental policies, including large investments in EV manufacturing and infrastructure, have been critical in supporting this growth.

-

United Kingdom: The first quarter of 2024 showed over the year-on-year growth in EV sales for the UK at over 15% keeping the overall growth similar to the previous year.