The Rise of Zero-Emission Freight

The transition toward clean freight is picking up speed. Over the past few years, we’ve seen a significant increase in zero-emission commercial trucks, delivery vans, and buses on our roads. This much-needed evolution of our on-road freight system is gaining momentum, and it’s happening none too soon.

Medium- and heavy-duty vehicles (MHDVs) make up just over 1 in 10 vehicles on our roads but are responsible for over half of the ozone-forming nitrogen oxide pollution and lung-damaging fine particulate pollution from on-road vehicles. They also disproportionately contribute to climate-warming emissions, representing around 30 percent of greenhouse gas pollution from vehicles on our roads and highways. Zero-emission trucks and buses eliminate tailpipe emissions and significantly reduce life-cycle pollution.

One indicator of this progress is the growing share of zero-emission truck and bus registrations. This data tells us which fleets are deploying electric vehicles, what types of vehicles are being deployed, and where they’re being used. Understanding this information is crucial to grasping how the market is developing.

Smaller Vehicles and Large Fleets Lead the Charge

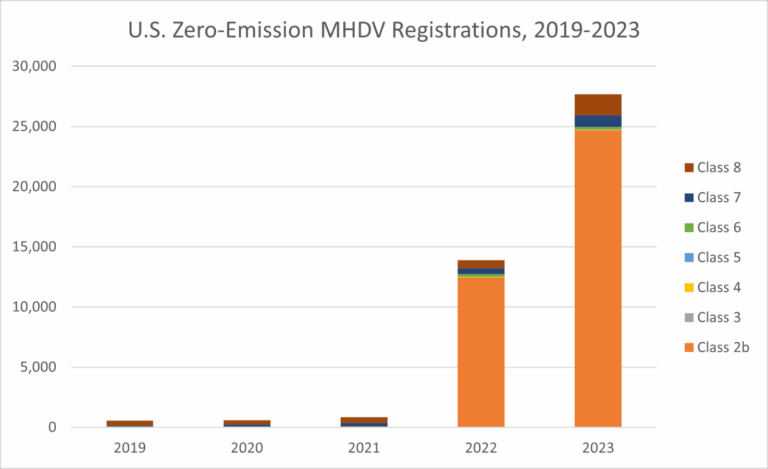

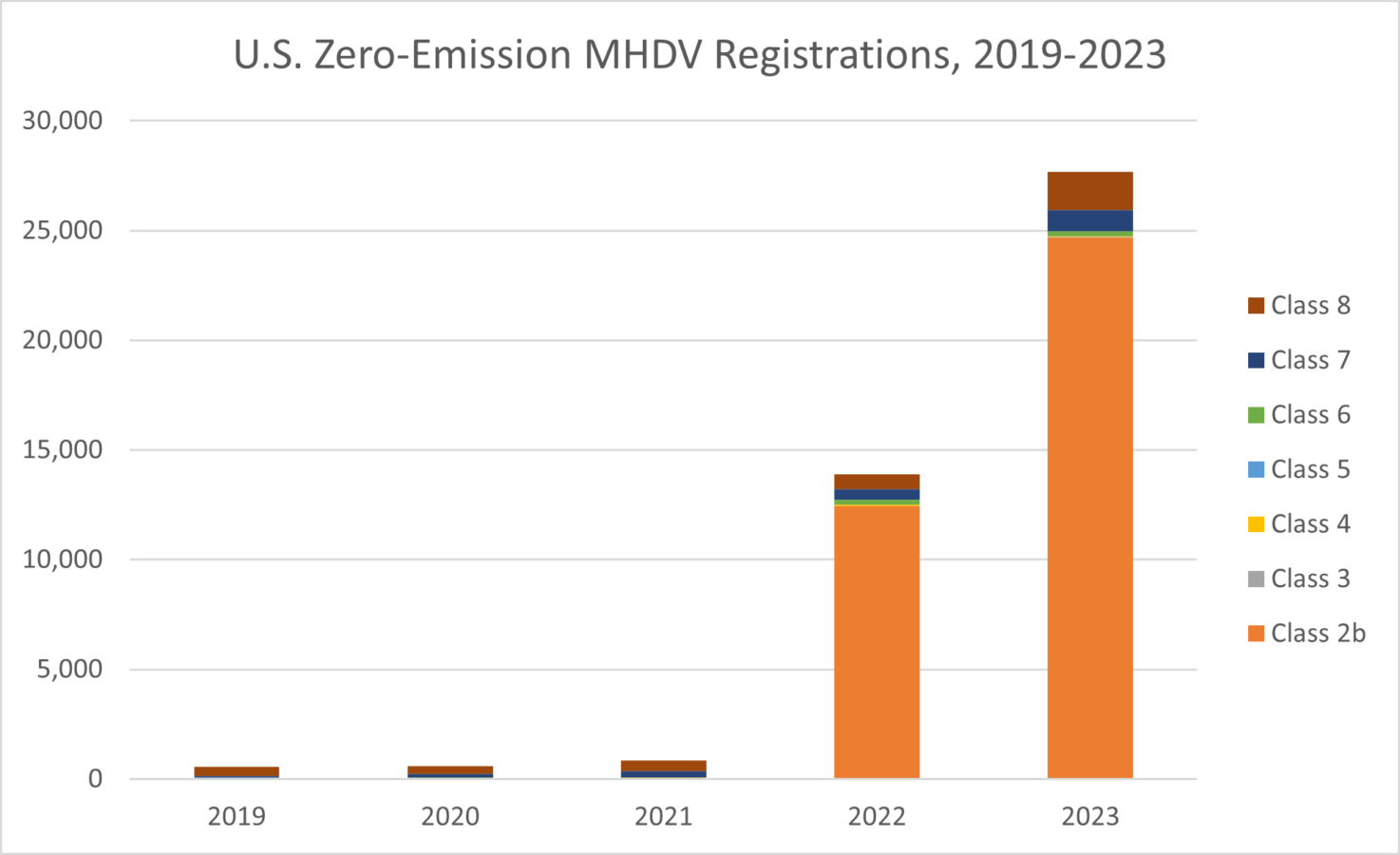

The number of zero-emission MHDVs deployed in the US has grown from around 600 in 2019 to over 27,500 in 2023. While this represents a small fraction of national MHDV sales (around 2.5 percent in 2023), the growth is impressive. Cargo vans, in particular, have seen significant growth in zero-emission vehicles (ZEVs), with over 22,000 now operating across the country.

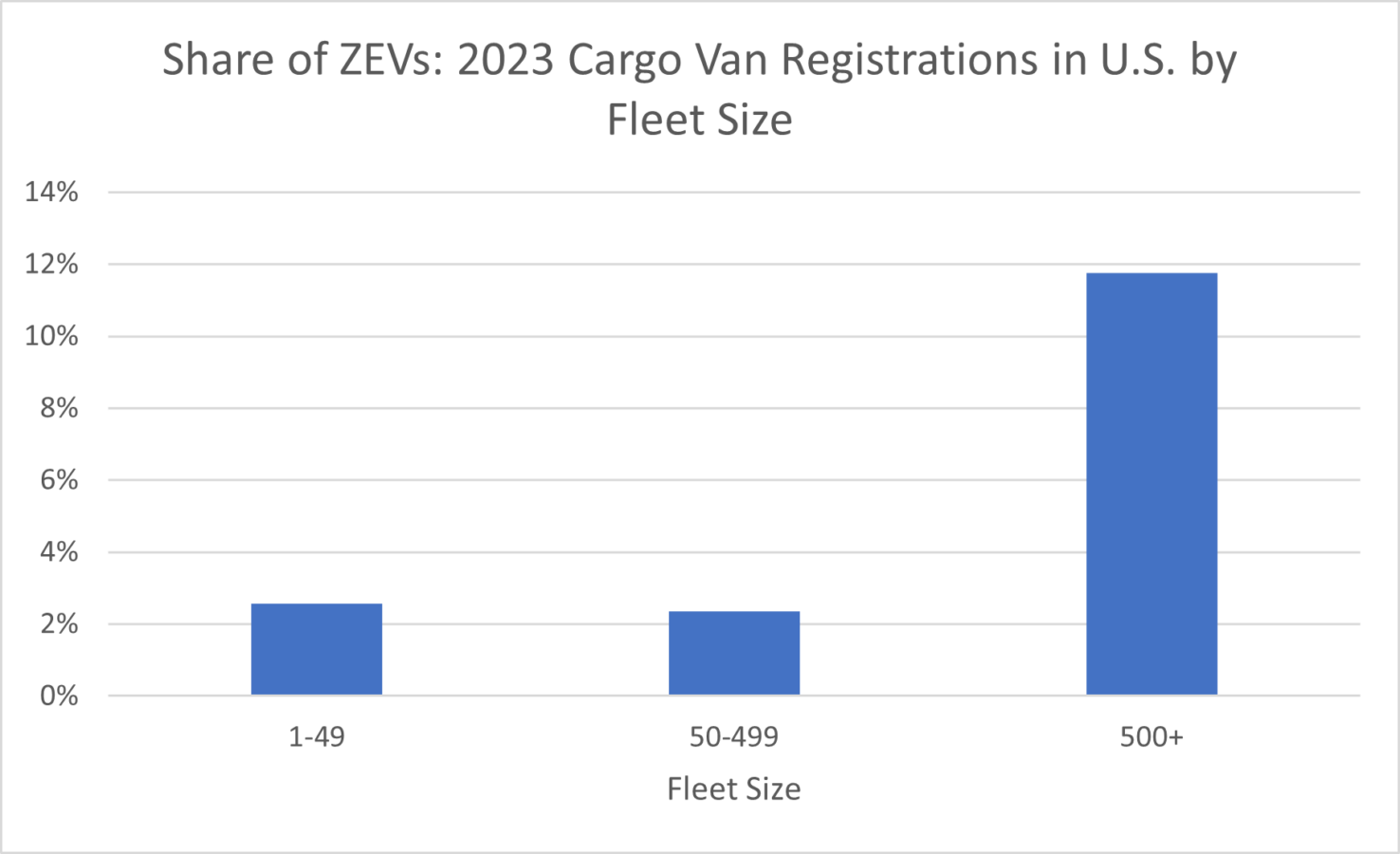

Large companies are leading this early growth, with around 12 percent of cargo vans registered by businesses operating over 500 vehicles being electric in 2023. This is compared to 2.58 percent by fleets with less than 50 vehicles and 2.35 percent by fleets with between 50 and 499 vehicles.

State-Level Adoption

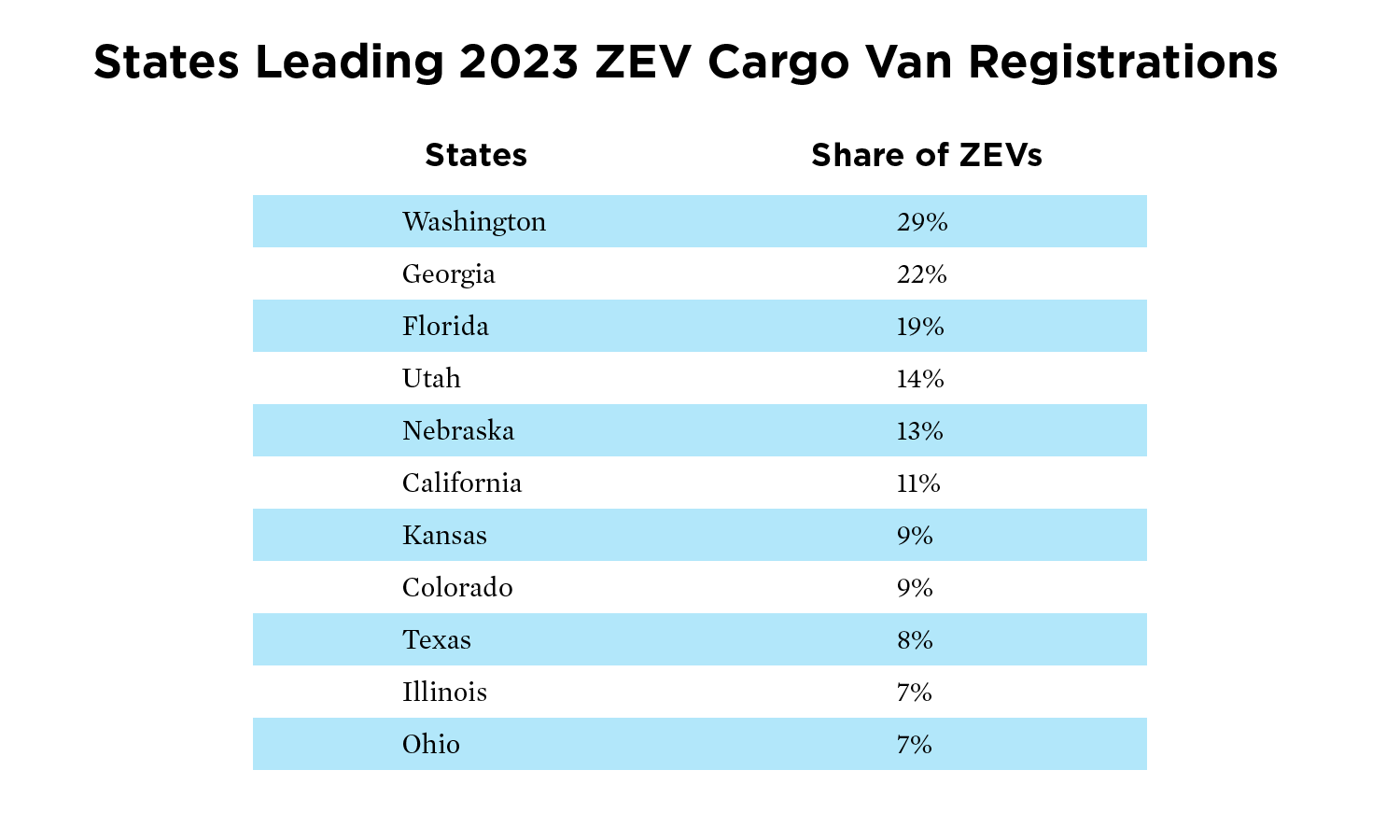

Some states are seeing more accelerated deployments than others. In 2023, nearly one in three cargo vans registered in Washington state were ZEVs. Georgia also stood out with over 22 percent ZEV registrations among cargo vans.

Factors Driving Adoption

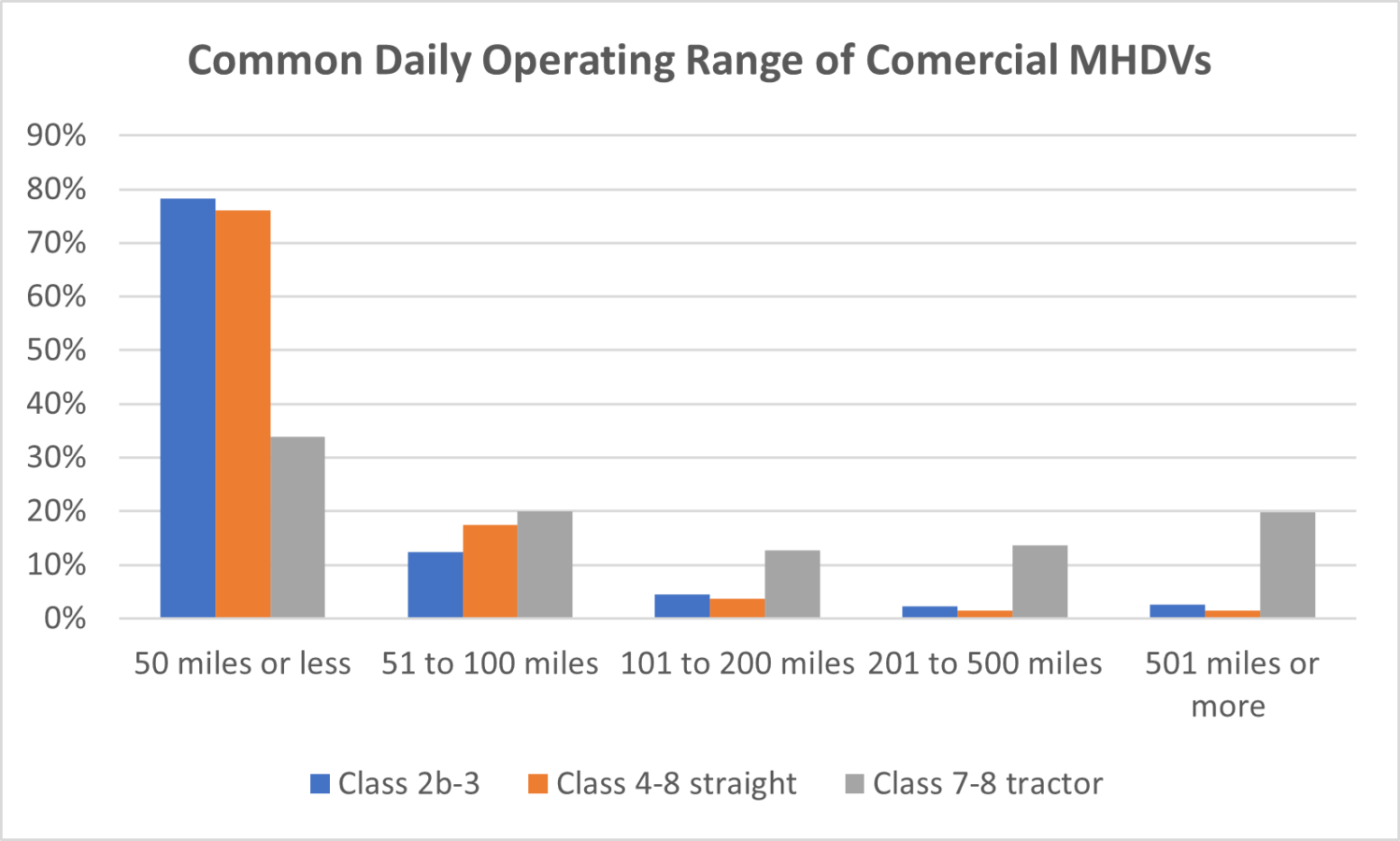

Several key factors are behind this accelerated adoption. Electrification makes sense in the last-mile delivery sector, where most vehicles travel less than 100 miles per day. The range of most common electric cargo vans is around 150 miles, making them suitable for this purpose.

Lower operating costs are another major factor. Electric cargo vans have significantly reduced operating costs compared to combustion models. For example, fuel costs for the electric version of Ford’s Transit cargo van are around $0.10/mile, while the gasoline-powered version costs around $0.19/mile.

The upfront prices of electric trucks and buses are anticipated to decline, making them more competitive. Incentives, such as the $7,500 federal tax credit and additional state incentives, are also driving adoption.

Conclusion

The growth of zero-emission freight is impressive and has significant implications for public health, the environment, and climate change. As the industry continues to evolve, it’s likely that we’ll see even more adoption of electric vehicles in the freight sector.