Investing in electric car stocks has proven lucrative for many investors, particularly those who have held onto Tesla (NASDAQ: TSLA) since its early days. The company’s shares have skyrocketed by over 22,000% since 2010 despite experiencing significant fluctuations. For investors seeking the next big success story in the EV market, Lucid Group (LCID -3.22%) and Rivian (RIVN -5.93%) are two stocks worth considering.

Lucid Group: High-Growth Potential

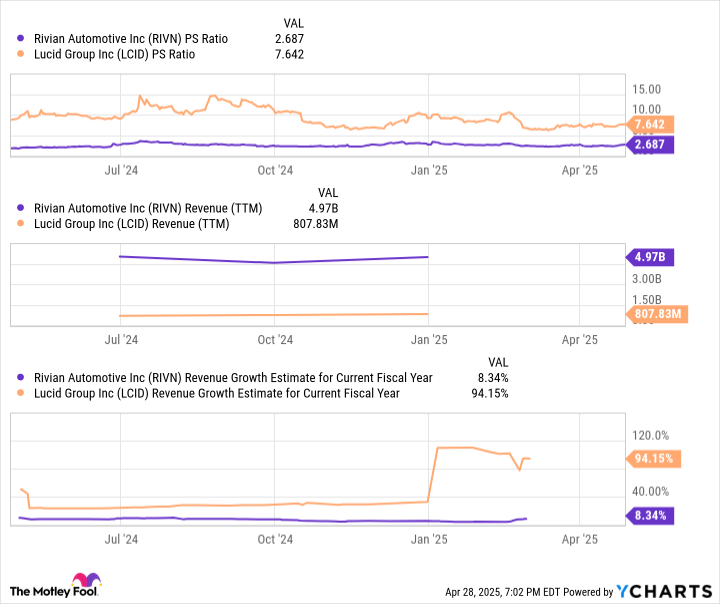

Lucid Group is currently growing at a faster rate than its competitors. Last year, the company sold nearly $1 billion worth of its luxury electric sedan, the Lucid Air. However, the high price point of between $70,000 and $250,000 limited its market appeal. The recent launch of the Gravity SUV platform has essentially doubled Lucid’s lineup and is expected to drive sales growth of 82% this year and 91% next year. While the Gravity starts at nearly $100,000, Lucid plans to launch several new models priced under $50,000 in 2026, potentially tapping into the mass market. Nevertheless, ramping up production of these new models poses a significant challenge for Lucid’s financial resources.

Rivian: Balanced Growth and Value

Despite Lucid’s impressive growth prospects, Rivian remains a more favorable option when balancing growth potential and valuation. Rivian currently offers two luxury models, the R1S and R1T, but is expected to start production on three more affordable vehicles, the R2, R3, and R3X, within the next 12 months. With a stronger cash position and a larger sales base than Lucid, Rivian is better positioned to bring its new models to market successfully. Although Rivian’s valuation is currently lower due to slower expected sales growth this year, its growth rates are anticipated to pick up significantly once the new models are launched. This makes Rivian an attractive option for patient investors looking for long-term growth at a reasonable valuation.