UK Automotive Production Dips in February, Marking a Year of Decline

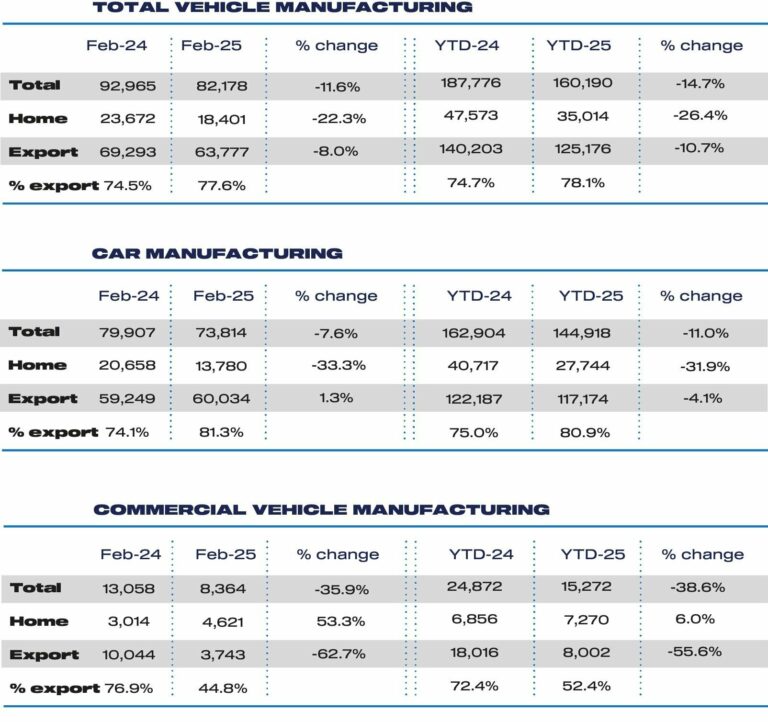

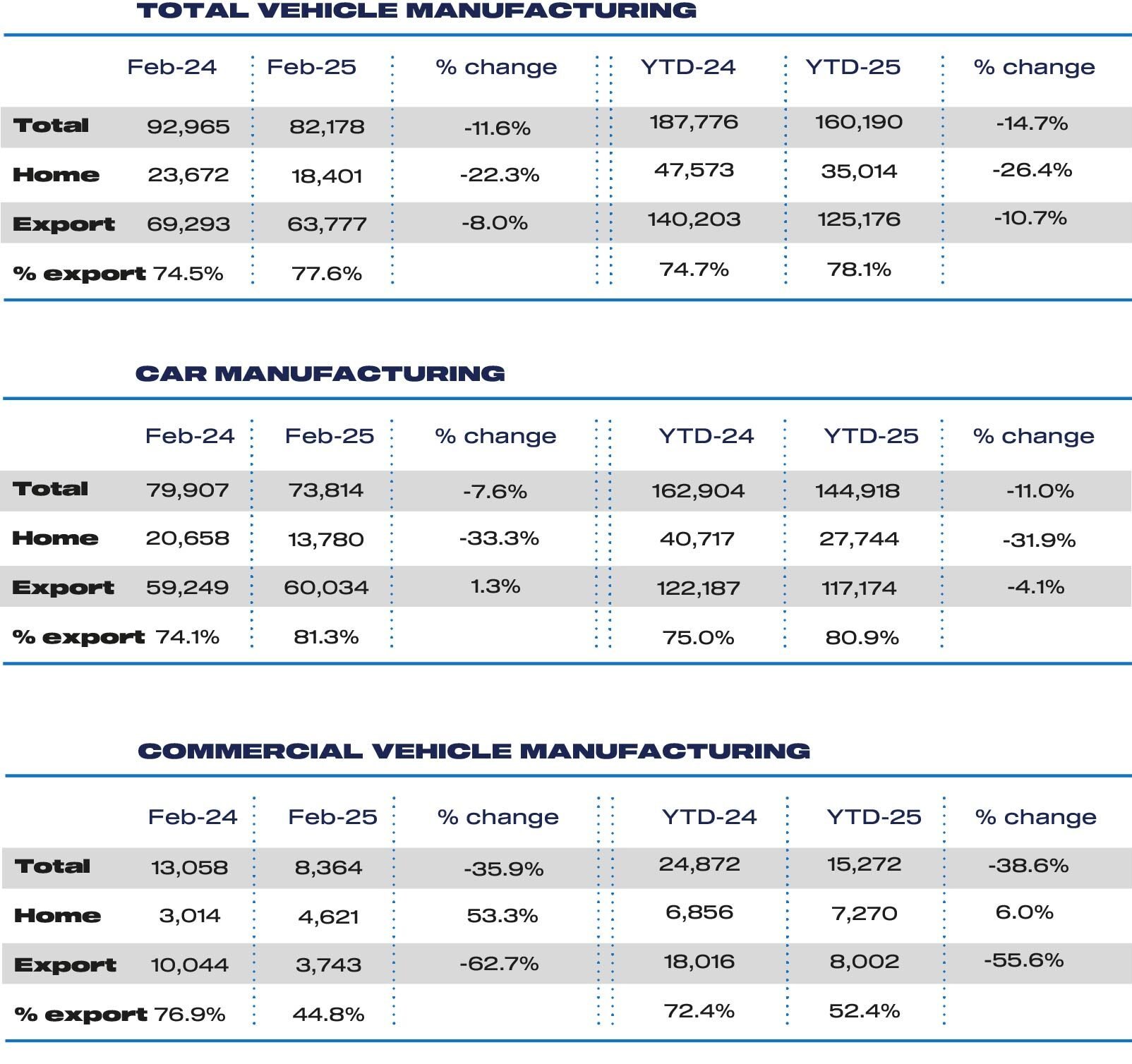

According to the Society of Motor Manufacturers and Traders (SMMT), UK car and commercial vehicle production experienced a significant downturn in February, declining by -11.6% to 82,178 units. This signifies a decrease of 10,787 units compared to the same month last year.

Car production has now fallen for 12 consecutive months, with various factors contributing to the decline. These include subdued domestic and international markets, model changeovers, and ongoing plant restructuring. While exports still represent the majority of output, concerns remain about the sector’s overall health.

Export and Domestic Market Performance

Notably, more than 80% of the cars manufactured in February were destined for export, with volumes increasing by 1.3% to 60,034 units. Simultaneously, car production for the UK market plummeted by -33.3% to 13,780 units.

The European Union remains the primary destination for UK car exports, accounting for 53.5% of the total. The United States ranks second, taking 19.7%, followed by China at 6.3%. Though shipments to the EU and China decreased by -9.6% and -10.9%, respectively, exports to the US saw a substantial rise of 34.6%. Turkey and Japan also emerged as key export markets, with significant growth in shipments of 75.5% and 119.2%, respectively.

Electrified Vehicle Production

Production of battery electric, plug-in hybrid, and hybrid cars saw a slight decrease of -5.6% to 27,398 units in February. However, these vehicles increased their market share to 37.1%, up from 36.3% in the previous year. For the year-to-date, electrified cars represent 39.6% of production, compared to 36.0% a year ago, with a more modest -2.1% fall in volumes compared with overall output down -11.0%.

Commercial Vehicle Production Declines Sharply

Commercial vehicle (CV) output experienced a significant drop of -35.9% to 8,364 units. This downturn was primarily driven by reduced van production, especially in comparison to the strong performance in February of the previous year. Domestic demand spurred volume, accounting for 55.2% of output, with volumes rising by over half to 4,621 units. However, CV exports declined by -62.7% to 3,743 units, with the majority (93.8%) shipped to the EU, representing a drop of 5,956 units.

Industry Calls for Policy Support

The SMMT has underscored the need for urgent measures to enhance the UK’s competitiveness and stimulate consumer demand. The industry criticized the recent Spring Statement by the Chancellor, which offered no specific support to the automotive sector or consumers, deeming it a missed opportunity. They also expressed concerns that additional fiscal measures scheduled to be introduced next month would discourage investment.

Mike Hawes, SMMT Chief Executive, expressed serious concerns about the sustained decline in car production. “These are worrying times for UK vehicle makers with car production falling for 12 months in a row, rising trade tensions and weak demand,” he said. “The market transition is not keeping pace with ambition and, while the industry can deliver growth – and green growth at that – it needs policies to deliver that reality. It was disappointing, therefore, to hear a Spring Statement that did nothing to alleviate the pressure on manufacturers and, moreover, confirms the introduction next month of additional fiscal measures which will actually dissuade consumers from investing. Without substantive regulatory easements our manufacturing viability remains at risk and the UK’s transition to zero emission mobility under threat.”

Chris Knight, VP, Automotive, at NTT DATA UK&I, mentioned the need for a clear industrial strategy. He stated, “Despite billions of pounds of investment to retool UK factories for EV manufacturing, the latest figures show a continued decline in UK automotive manufacturing output… Clear direction from UK Government on the industrial strategy will increase the confidence and investment needed to drive long term manufacturing growth, and will help secure the thousands of jobs dependent on this success of the UK sector.”

To foster growth, the industry emphasizes the importance of a strong and increasingly electrified new vehicle market. The government is urged to support the transition to electric vehicles by abolishing the VED Expensive Car Supplement for EVs, reducing VAT on public charging and new BEV sales, expanding the Plug-in Truck Grant, and mandating infrastructure rollout targets.