UK LCV Market Sees Growth, but Electric Van Uptake Stalls

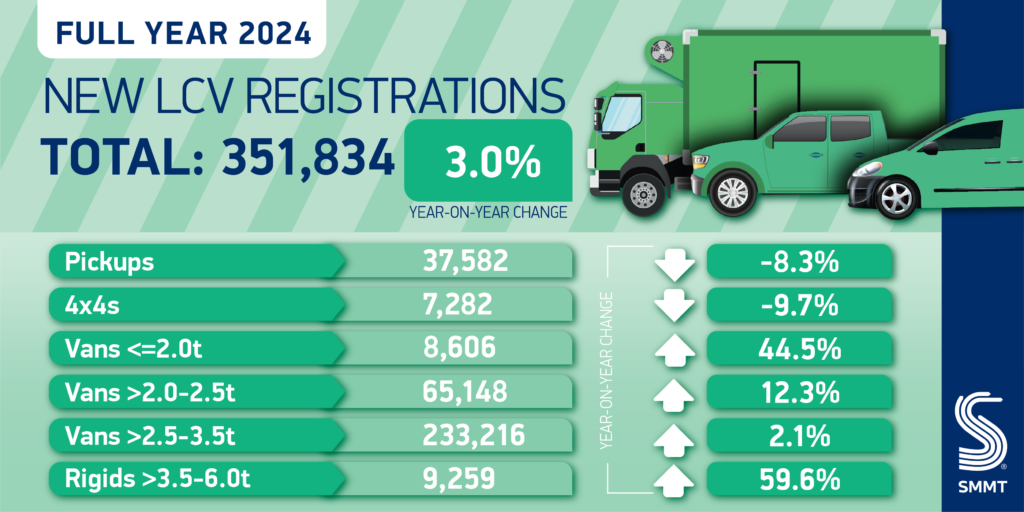

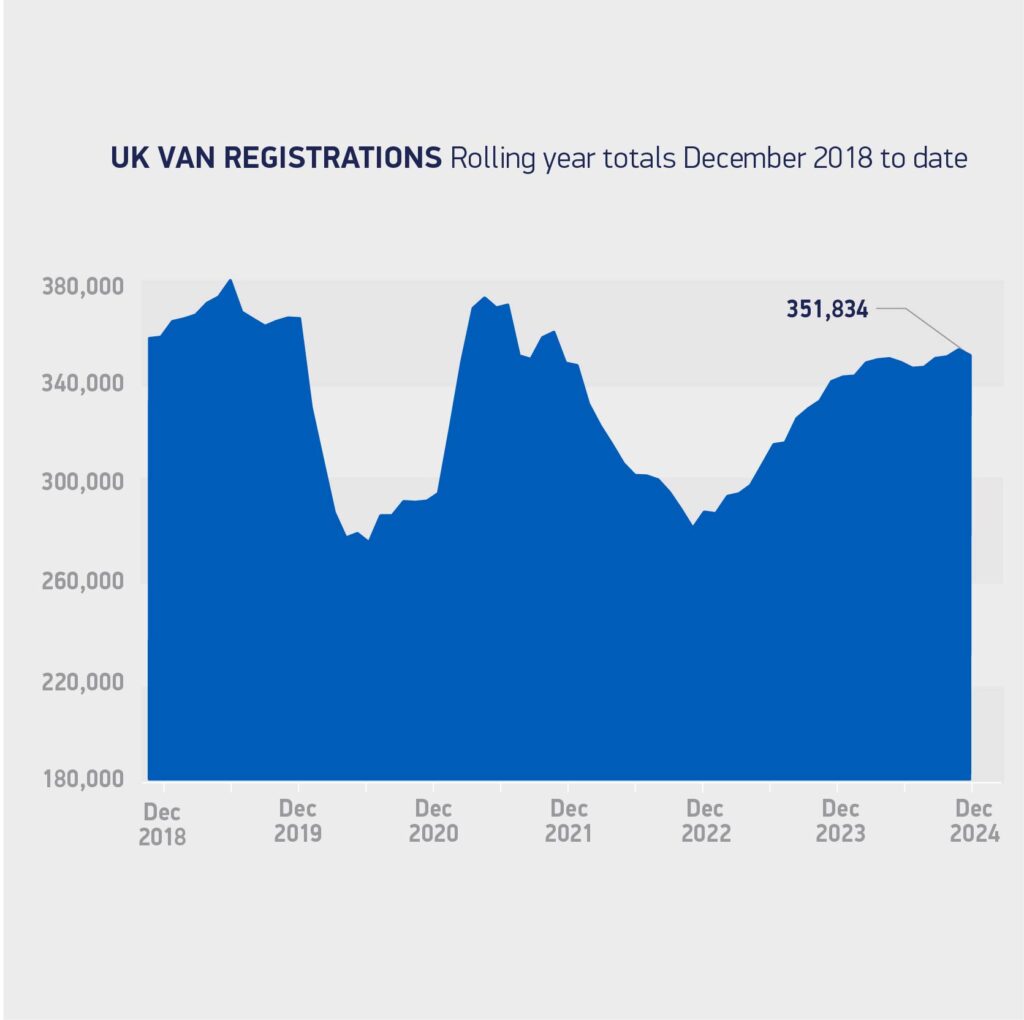

London, 6 January 2025 – The UK’s light commercial vehicle (LCV) market experienced a 3.0% increase in registrations in 2024, surpassing 350,000 units, according to the Society of Motor Manufacturers and Traders (SMMT).

A robust December, with 27,221 new LCVs registered, contributed to a total of 351,834 new vans, pick-ups, and 4x4s throughout the year. This makes 2024 the best year for fleet renewal since 2021.

Demand increased across all van weight classes last year. The largest vans saw a 2.1% rise in uptake, representing 66.3% of the market. Medium and small-sized vans also saw growth, increasing by 12.3% and 44.5% to 65,148 units and 8,606 units, respectively.

However, deliveries of new 4x4s declined by -9.7% to 7,282 units, compared to a strong 2023 performance. New pick-up registrations also saw a decrease of -8.3% to 37,582 units. This decline may worsen in 2025 due to the government’s decision to tax double-cab pick-ups as cars for benefit in kind and capital allowances purposes from April.

Electric Van Demand Stagnant

A significant concern remains the slow growth of the battery electric van (BEV) sector. While new BEV registrations rose by 3.3% to 22,155 units, its share of the overall market remained static at 6.3% – the same as in 2023.

This modest growth in the first year of the UK’s Zero Emission Vehicle Mandate highlights the considerable challenge in accelerating the decarbonization of light commercial vehicles.

Despite the vast market investment, UK operators had 33 different zero-emission van models to choose from last year, representing more than half (52.4%) of all new models available.

With the government’s Zero Emission Vehicle Mandate setting a 10% target for 2024, the current uptake is significantly short of this goal. Even if, as the industry expects, demand rises by more than 85% in 2025, the UK’s BEV share would only reach 10.6% – a considerable distance from the 16% required this year.

With market demand for BEVs falling short of expectations, the government must expedite the review of the mandate and ensure the regulation reflects market realities, barriers, and necessary support to drive growth. This also needs ambitious incentives and infrastructure rollout.

Mike Hawes, SMMT Chief Executive, commented:

“Vans, 4x4s and pick-ups keep businesses moving, making this sector a barometer of the UK economy. The best overall volume in three years, is good news with van makers striving to deliver abundant and competitive EV choice. Buyer confidence, however, will inevitably be undermined when charging infrastructure does not meet the needs of fleet operations. A review of EV regulation is crucial, therefore, to reflect current market realities and ensure ambitions are deliverable, without any negative and costly consequences.”