UK Light Commercial Vehicle Market Sees Continued Decline

New light commercial vehicle (LCV) registrations in the UK fell by 14.9% in April 2025, marking the fifth consecutive month of decline, according to the Society of Motor Manufacturers and Traders (SMMT). The total number of registrations reached 20,332 units, representing the worst April performance since 2020. The decline is attributed to weak business confidence and a challenging economic environment, which are discouraging fleet upgrades to newer, zero-emission vehicles.

The decline was primarily led by a 22.9% drop in registrations of larger vans (>2.5-3.5T), which fell to 12,113 units. Although this category still accounted for nearly six in ten (59.6%) new LCV registrations, the significant decrease indicates softening demand across various van sizes. Smaller and medium vans also experienced declines, with registrations dropping by 5.5% and 5.8% respectively. In contrast, registrations of 4x4s rose by 19.2% to 564 units, and pickups saw a 10.2% increase to 2,740 units, possibly due to orders placed before the introduction of new tax measures affecting double-cabs.

The top models in April included the Ford Transit Custom (2,560 units), Ford Transit (1,630 units), and Ford Ranger (1,216 units). Year-to-date, the Ford Transit Custom remained the leading model with 16,906 registrations.

On a positive note, demand for new battery electric vans (BEVs) weighing up to 4.25 tonnes surged by 77.5% to 1,686 units in April, representing 8.3% of the market. This growth is attributed to significant investment by manufacturers, with nearly 40 different BEV models now available in the UK market. However, the current uptake remains below the mandated 16% market share for 2025.

Mike Hawes, SMMT Chief Executive, emphasized the need for bold action to meet ambitious mandate targets, including preferential treatment for grid connections, more affordable energy, and consistent local planning policies. The industry requires an overhaul of the grid connection process, as current procedures may result in van operators waiting up to 15 years for depot charging connections.

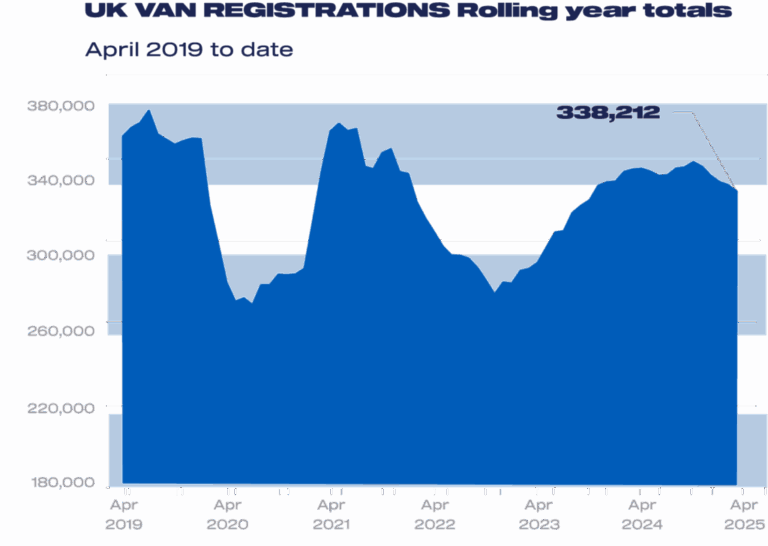

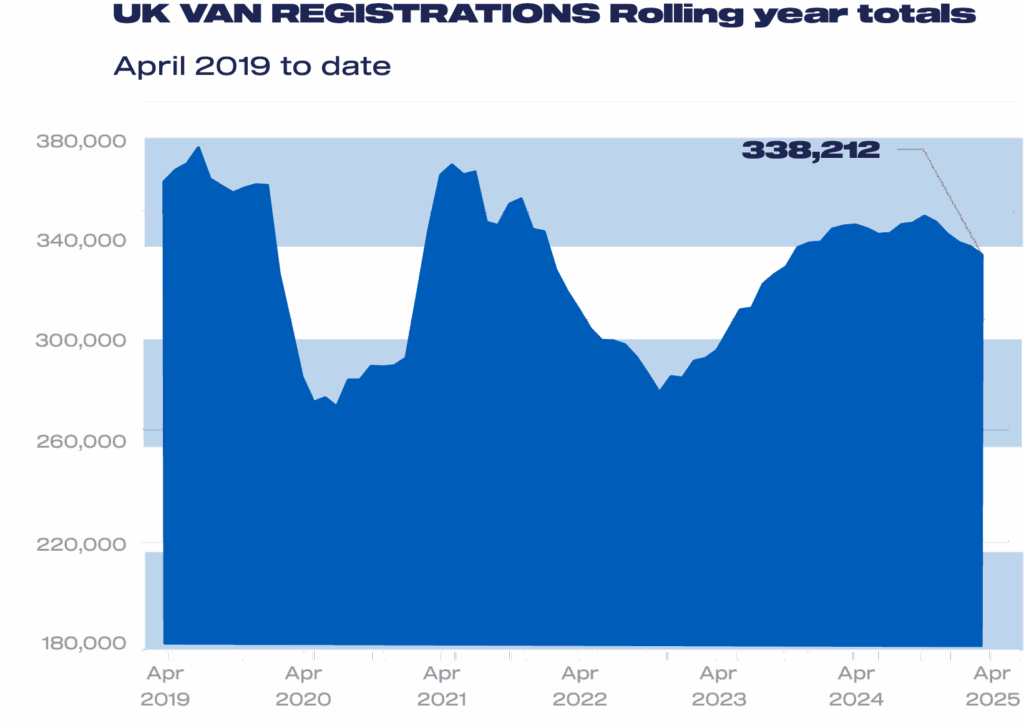

The SMMT has revised its market outlook for 2025, expecting the new LCV market to decline by 4.3% to 337,000 units, with BEV share reaching only 9.1% by year-end, significantly below the mandated target.