Vehicle Inventory Levels Surge, Bringing Back Discounts for Consumers

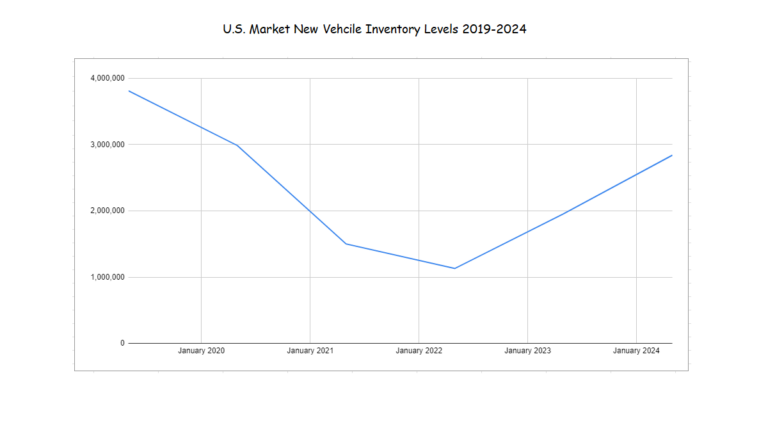

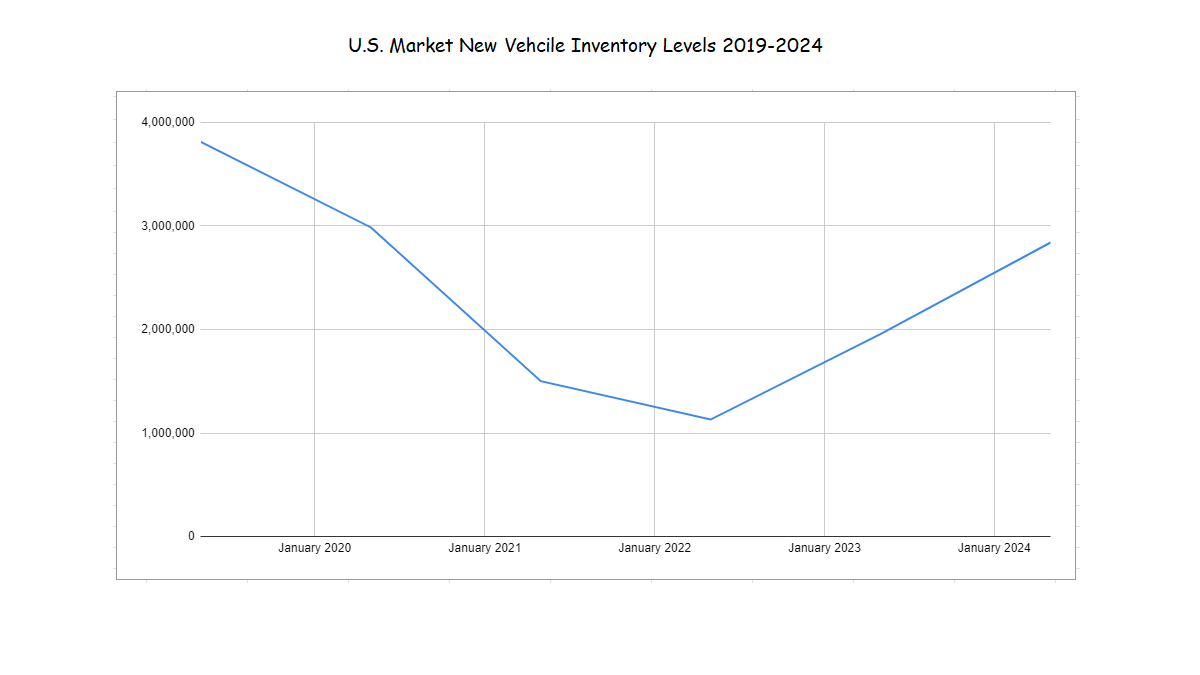

The U.S. market is seeing a significant increase in the number of new vehicles available. This rise in inventory is comparable to pre-shortage levels, offering car buyers some good news.

Data from Cox Automotive at the start of May shows that the new car inventory level is around 2.84 million vehicles at dealerships and retailers nationwide. This represents a healthy 76-day supply, the highest May inventory since 2020, and a 51% increase compared to last year. In the past twelve months, inventory has grown by almost 1 million vehicles.

Automakers’ Shift in Strategy

Automakers previously aimed for low inventories, some vowing to never return to the days pre-shortage levels. However, market dynamics, including competition and the quest to maintain market share, have led to increased production.

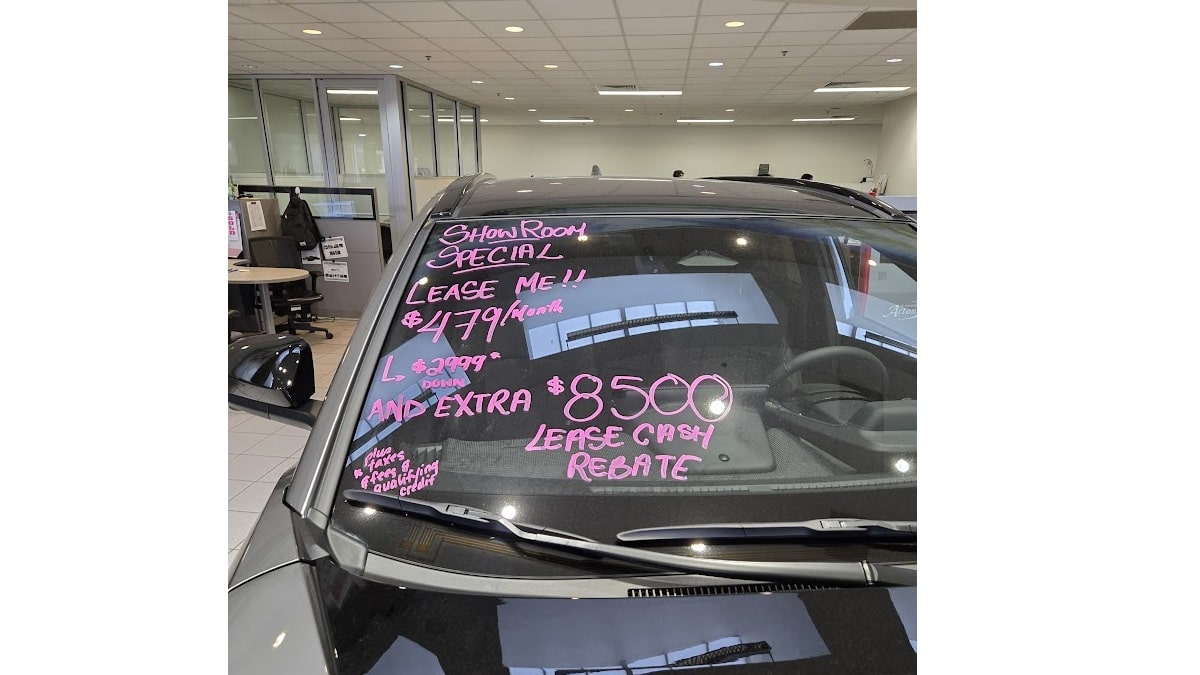

Karl Brauer, iSeeCars Executive Analyst, noted that automakers understand that to stay competitive, they need to offer a diverse selection of vehicles. This oversupply leads to lower prices, increased discounts, and attractive incentives such as cash rebates and low interest rates.

The Current Market Dynamics

During the vehicle shortage, automakers realized higher profits were possible with limited inventory. But, market forces have changed that perspective.

The brands within Stellantis, including Jeep, Ram, Chrysler, and Dodge, currently have the most excess inventory. Both Jeep and Ram have double the industry average.

For instance, Dodge has six months’ worth of Hornet inventory on hand. Tesla is also dealing with a surplus, though minimal data is available because it doesn’t participate in standard industry reporting. Tesla’s production now exceeds deliveries, resulting in inventory accumulation.

Conversely, Toyota currently has the least inventory. This is due to the popularity of their hybrid technology. Demand for Toyota hybrids is high, and the company is reducing conventional powertrain options.

Incentives and Discounts in the Market

The vehicles that require the most incentives to sell are those with battery-electric powertrains. Tesla, in particular, has reintroduced several sales tactics to move its surplus inventory.

Historically, Tesla has raised prices during inventory shortages. In contrast, since the end of these shortages, Tesla has reduced MSRPs, offered discounts on in-stock models, and advertised low interest rates.

Factors Influencing Inventory Control

Several factors make it challenging for manufacturers to control product flow. Predicting market reactions to new models can be difficult.

Volume-based metrics are often used to measure success, which can lead to an emphasis on pushing sales, influencing inventory levels. Production needs, along with union influence and rules, also impact how the inventory of vehicles is handled.

Looking Ahead to Late 2024 and 2025

Experts find it difficult to predict what market changes may come. External factors such as political events, economic shifts, and global circumstances can significantly impact vehicle demand.

Final Thoughts

If you are in the market for a new vehicle this summer, overstocked models may offer the best value. It’s a favorable time for those interested in a Tesla Model Y, Ram, Jeep, or Dodge. However, if you are looking for a Toyota hybrid, you may still face limited selection and potentially higher prices or the need to order in advance.

The trend indicates a return to inventory levels resembling historical norms, with sticker price reductions and more incentives. This shift signals a positive development for car shoppers.